PG&E 2007 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132

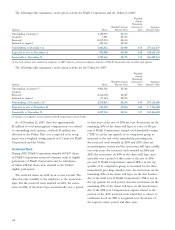

At December 31, 2007, the undiscounted obligations

under nuclear fuel agreements were as follows:

(in millions)

2008 $ 82

2009 82

2010 113

2011 98

2012 88

Thereafter 620

Total $1,083

Payments for nuclear fuel amounted to approximately

$102 million in 2007, $106 million in 2006, and $65 million

in 2005.

Other Commitments and Operating Leases

The Utility has other commitments relating to operating

leases, vehicle leasing, and telecommunication and infor-

mation system contracts. At December 31, 2007, the future

minimum payments related to other commitments were

as follows:

(in millions)

2008 $ 43

2009 16

2010 13

2011 12

2012 26

Thereafter 28

Total $138

Payments for other commitments and operating leases

amounted to approximately $38 million in 2007, $100 mil-

lion in 2006, and $146 million in 2005.

Underground Electric Facilities

At December 31, 2007, the Utility was committed to

spending approximately $236 million for the conversion

of existing overhead electric facilities to underground

electric facilities. These funds are conditionally committed

depending on the timing of the work, including the

schedules of the respective cities, counties, and telephone

utilities involved. The Utility expects to spend approximately

$50 million to $60 million each year in connection with

these projects. Consistent with past practice, the Utility

expects that these capital expenditures will be included

in rate base as each individual project is completed and

recoverable in rates charged to customers.

CONTINGENCIES

PG&E CORPORATION

PG&E Corporation retains a guarantee related to certain

indemnity obligations of its former subsidiary, NEGT, that

were issued to the purchaser of an NEGT subsidiary company.

PG&E Corporation’s sole remaining exposure relates to any

potential environmental obligations that were known to

NEGT at the time of the sale but not disclosed to the pur-

chaser, and is limited to $150 million. PG&E Corporation has

not received any claims nor does it consider it probable that

any claims will be made under the guarantee. At December 31,

2007, PG&E Corporation’s potential exposure under this

guarantee was immaterial and PG&E Corporation has not

made any provision for this guarantee.

UTILITY

Nuclear Insurance

The Utility has several types of nuclear insurance for

Diablo Canyon and Humboldt Bay Unit 3. The Utility has

insurance coverage for property damages and business inter-

ruption losses as a member of Nuclear Electric Insurance

Limited (“NEIL”). NEIL is a mutual insurer owned by utili-

ties with nuclear facilities. NEIL provides property damage

and business interruption coverage of up to $3.24 billion

per incident for Diablo Canyon. In addition, NEIL provides

$131 million of property damage insurance for Humboldt

Bay Unit 3. Under this insurance, if any nuclear generating

facility insured by NEIL suffers a catastrophic loss causing

a prolonged outage, the Utility may be required to pay an

additional premium of up to $38.5 million per one-year

policy term.

NEIL also provides coverage for damages caused by acts of

terrorism at nuclear power plants. Under the Terrorism Risk

Insurance Program Reauthorization Act of 2007 (“TRIPRA”),

acts of terrorism may be “certifi ed” by the Secretary of the

Treasury. For a certifi ed act of terrorism, NEIL can obtain

compensation from the federal government and will provide

up to the full policy limits to the Utility for an insured loss.

If one or more non-certifi ed acts of terrorism cause property

damage covered under any of the nuclear insurance policies

issued by NEIL to any NEIL member, the maximum recov-

ery under all those nuclear insurance policies may not exceed

$3.24 billion within a 12-month period plus the additional

amounts recovered by NEIL for these losses from reinsurance.

TRIPRA extends the Terrorism Risk Insurance Act of 2002

through December 31, 2014.