PG&E 2007 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

In order to enhance the credit ratings of these pollution control bonds, the Utility has obtained credit support from

banks and insurance companies such that, in the event that the Utility does not pay debt servicing costs, the banks or

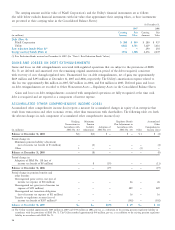

insurance companies will pay the debt servicing costs. The following table summarizes these credit supports:

Utility Facility(1) At December 31, 2007

(in millions) Series Termination Date Commitment

Pollution control bond — bank reimbursement agreements 96 C, E, F, 97 B February 2012 $ 620

Pollution control bond — bond insurance reimbursement agreements 96 A December 2016(2) 200

Pollution control bond — bond insurance reimbursement agreements 2004 A–D December 2023(2) 345

Pollution control bond — bond insurance reimbursement agreements 2005 A–G 2016–2026(2) 454

Total credit support $1,619

(1) Off-balance sheet commitments.

(2) Principal and debt service insured by bond insurance companies.

Generally, under the loan agreements related to the Utility’s pollution control bonds, the Utility, among other things,

agrees to pay principal, interest, or any premium on the bonds to the trustee in accordance with the relevant indentures,

maintain and repair the underlying projects fi nanced by such bonds, and not take any action or fail to take any action if

any such action or inaction would cause the interest on the bonds to be taxable or to be other than “exempt facility bonds”

within the meaning of Section 142(a) of the Code.

In 2005, the Utility purchased a fi nancial guaranty insurance policy to insure the regularly scheduled payment of prin-

cipal and interest on $454 million of pollution control bonds series 2005 A-G (“PC2005 bonds”) issued by the California

Infrastructure and Economic Development Bank. In January 2008, the insurer’s credit rating was downgraded and/or put

on review for possible downgrade by several credit agencies. This has resulted in increases in interest rates for the PC2005

bonds, which rates are currently set at auction every 7 or 35 days. To minimize this interest rate exposure, the Utility intends

to exercise its right to purchase the bonds in lieu of redemption and remarket the bonds when market conditions are more

favorable. The purchase of the PC2005 bonds is expected to be fi nanced through issuance of long-term debt.

Repayment Schedule

At December 31, 2007, PG&E Corporation’s and the Utility’s combined aggregate principal repayment amounts of long-term

debt are refl ected in the table below:

(in millions, except interest rates) 2008 2009 2010 2011 2012 Thereafter Total

Long-term debt:

PG&E Corporation

Average fi xed interest rate — — 9.50% — — — 9.50%

Fixed rate obligations — — $ 280 — — — $ 280

Utility

Average fi xed interest rate — 3.60% — 4.20% — 5.66% 5.37%

Fixed rate obligations — $ 600 — $ 500 — $5,745 $6,845

Variable interest rate as of December 31, 2007 — — — — 3.56% 4.47% 3.95%

Variable rate obligations — — — — $ 614(1) $ 454 $1,068

Total consolidated long-term debt — $ 600 $ 280 $ 500 $ 614 $6,199 $8,193

(1) The $614 million pollution control bonds, due in 2026, are backed by letters of credit which expire on February 24, 2012. The bonds will be subject to a

mandatory redemption unless the letters of credit are extended or replaced. Accordingly, the bonds have been classifi ed for repayment purposes in 2012.