PG&E 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

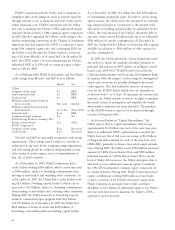

CONTRACTUAL COMMITMENTS

The following table provides information about the Utility’s and PG&E Corporation’s contractual obligations and

commitments at December 31, 2007. PG&E Corporation and the Utility enter into contractual obligations in connection

with business activities. These future obligations primarily relate to fi nancing arrangements (such as long-term debt, preferred

stock, and certain forms of regulatory fi nancing), purchases of transportation capacity, natural gas and electricity to support

customer demand, and the purchase of fuel and transportation to support the Utility’s generation activities. (See Note 17

of the Notes to the Consolidated Financial Statements.)

Payment due by period

Less than More than

(in millions) Total 1 year 1–3 years 3–5 years 5 years

Contractual Commitments:

Utility

Purchase obligations:

Power purchase agreements(1):

Qualifying facilities $17,185 $1,770 $3,248 $2,891 $ 9,276

Irrigation district and water agencies 479 83 164 107 125

Renewable contracts 8,783 245 672 1,026 6,840

Other power purchase agreements 716 238 386 79 13

Natural gas supply and transportation 1,446 1,181 244 21 —

Nuclear fuel 1,083 82 195 186 620

Preferred dividends(2) 70 14 28 28 —

Other commitments(3) 26 24 2 — —

Pension and other benefi ts(4) 900 300 600 — —

Operating leases 112 19 27 38 28

Long-term debt(5):

Fixed rate obligations 13,910 368 1,303 1,161 11,078

Variable rate obligations 1,796 28 53 688 1,027

Other long-term liabilities refl ected on the Utility’s balance sheet under GAAP:

Energy recovery bonds(6) 2,177 435 871 871 —

Capital lease obligations(7) 503 50 100 100 253

PG&E Corporation

Long-term debt(5):

Convertible subordinated notes 345 27 318 — —

(1) This table does not include DWR allocated contracts because the DWR is currently legally and fi nancially responsible for these contracts and payments.

See Note 17 of the Notes to the Consolidated Financial Statements for the Utility’s contractual commitments including power purchase agreements

(including agreements with qualifying facility co-generators, irrigation districts, and water agencies and renewable energy providers), natural gas supply

and transportation agreements, and nuclear fuel agreements.

(2) Preferred dividend estimates beyond fi ve years are not included as these dividend payments continue in perpetuity.

(3) Includes commitments for telecommunications and information system contracts in the aggregate amount of approximately $6 million, vehicle leasing

arrangements in the aggregate amount of $3 million, and SmartMeter™ contracts in the aggregate amount of approximately $17 million.

(4) PG&E Corporation’s and the Utility’s funding policy is to contribute tax-deductible amounts, consistent with applicable regulatory decisions, suffi cient

to meet minimum funding requirements. (See Note 14 of the Notes to the Consolidated Financial Statements.)

(5) Includes interest payments over the terms of the debt. Interest is calculated using the applicable interest rate and outstanding principal for each

instrument with the terms ending at each instrument’s maturity. (See Note 4 of the Notes to the Consolidated Financial Statements.)

(6) Includes interest payments over the terms of the bonds. (See Note 6 of the Notes to the Consolidated Financial Statements.)

(7) See Note 17 of the Notes to the Consolidated Financial Statements.

The contractual commitments table above excludes

potential commitments associated with the conversion of

existing overhead electric facilities to underground electric

facilities. At December 31, 2007, the Utility was committed

to spending approximately $236 million for these conver-

sions. These funds are conditionally committed depending

on the timing of the work, including the schedules of the

respective cities, counties, and telephone utilities involved.

The Utility expects to spend approximately $50 million to

$60 million each year in connection with these projects.

Consistent with past practice, the Utility expects that these

capital expenditures will be included in rate base as each

individual project is completed and recoverable in rates

charged to customers.

The contractual commitments table above also excludes

potential payments associated with unrecognized tax benefi ts

accounted for under Financial Accounting Standards Board

(“FASB”) Interpretation No. 48 “Accounting for Uncertainty

in Income Taxes,” (“FIN 48”). On January 1, 2007, PG&E

Corporation and the Utility adopted the provisions of