PG&E 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

SFAS No. 123R, PG&E Corporation and the Utility recog-

nize compensation expense for all awards over the shorter

of the stated vesting period or the requisite service period.

If awards granted prior to adopting SFAS No. 123R were

expensed over the requisite service period instead of the

stated vesting period, there would have been an immaterial

impact on the Consolidated Financial Statements of PG&E

Corporation and the Utility for 2006.

Prior to the adoption of SFAS No. 123R, PG&E

Corporation and the Utility presented all tax benefi ts from

share-based payment awards as operating cash fl ows in the

Consolidated Statements of Cash Flows. SFAS No. 123R

requires that cash fl ows from the tax benefi ts resulting from

tax deductions in excess of the compensation cost recog-

nized for those awards (excess tax benefi ts) be classifi ed as

fi nancing cash fl ows.

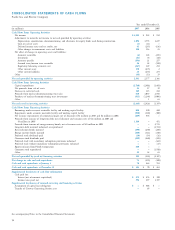

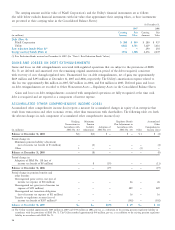

The tables below show the effect on PG&E Corporation’s

net income and EPS if PG&E Corporation and the Utility

had elected to account for stock-based compensation using

the fair value method under SFAS No. 123 based on the

valuation assumptions disclosed in Note 14, for the year

ended December 31, 2005:

Year ended December 31,

(in millions, except per share amounts) 2005

Net earnings:

As reported $ 917

Deduct: Incremental stock-based employee

compensation expense determined

under the fair value based method

for all awards, net of related tax effects (12)

Pro forma $ 905

Basic earnings per share:

As reported $2.40

Pro forma 2.37

Diluted earnings per share:

As reported 2.37

Pro forma 2.33

If compensation expense had been recognized using the

fair value based method under SFAS No. 123, the Utility’s

pro forma consolidated earnings would have been as follows:

Year ended December 31,

(in millions) 2005

Net earnings:

As reported $918

Deduct: Incremental stock-based employee

compensation expense determined

under the fair value based method

for all awards, net of related tax effects (7)

Pro forma $911

NUCLEAR DECOMMISSIONING TRUSTS

The Utility accounts for its investments held in the

Nuclear Decommissioning Trusts in accordance with SFAS

No. 115, “Accounting for Certain Investments in Debt and

Equity Securities” (“SFAS No. 115”), as well as FASB Staff

Position Nos. 115-1 and 124-1, “The Meaning of Other-

Than-Temporary Impairment and Its Application to Certain

Investments” (“SFAS Nos. 115-1 and 124-1”). Under SFAS

No. 115, the Utility records realized gains and losses as addi-

tions and reductions to trust asset balances. In accordance

with SFAS Nos. 115-1 and 124-1, the Utility recognizes an

impairment of an investment if the fair value of that invest-

ment is less than its cost and if the impairment is concluded

to be other-than-temporary. (See Note 13 of the Notes to the

Consolidated Financial Statements for further discussion.)

ACCOUNTING FOR DERIVATIVES

AND HEDGING ACTIVITIES

The Utility engages in price risk management activities to

manage its exposure to fl uctuations in commodity prices.

Price risk management activities involve entering into con-

tracts to procure electricity, natural gas, nuclear fuel, and

fi rm transmission rights for electricity.

The Utility uses a variety of energy and fi nancial instru-

ments, such as forward contracts, futures, swaps, options

and other instruments, and agreements, most of which are

accounted for as derivative instruments. Some contracts are

accounted for as leases. Derivative instruments are recorded

in PG&E Corporation’s and the Utility’s Consolidated

Balance Sheets at fair value. Changes in the fair value of

derivative instruments are recorded in earnings, or to the

extent they are recoverable through regulated rates, are

deferred and recorded in regulatory accounts. Derivative

instruments may be designated as cash fl ow hedges when

they are entered into to hedge variable price risk associated

with the purchase of commodities. For cash fl ow hedges, fair

value changes are deferred in accumulated other comprehen-

sive income and recognized in earnings as the hedged trans-

actions occur, unless they are recovered in rates, in which

case, they are recorded in regulatory accounts. Derivative

instruments are presented in other current and noncurrent

assets or other current and noncurrent liabilities unless they

meet certain exemptions as discussed below.

In order for a derivative instrument to be designated as

a cash fl ow hedge, the relationship between the derivative

instrument and the hedged item or transaction must be

highly effective. The effectiveness test is performed at the

inception of the hedge and each reporting period thereafter,

throughout the period that the hedge is designated as such.

Unrealized gains and losses related to the effective and