PG&E 2007 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

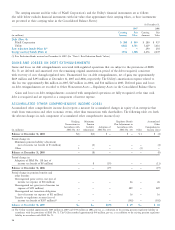

Interest expense was calculated and included in the poten-

tial liability for uncertain tax positions for the 12 months

ended December 31, 2007. Interest expense was classifi ed

as income tax expense in the Consolidated Statements of

Income as follows:

PG&E

(in millions) Corporation Utility

For the 12 months ended

December 31, 2007

Increase in interest expense accrued on

unrecognized tax benefi ts $7 $2

PG&E Corporation and the Utility believe that it is

reasonably possible that the total amount of unrecognized

tax benefi ts could decrease by up to $10 million in the

next 12 months as a result of a potential settlement of the

2001–2002 Internal Revenue Service (“IRS”) audit.

For a description of tax years that remain subject to

examination, see discussion in Note 11 of the Notes to the

Consolidated Financial Statements.

ACCOUNTING PRONOUNCEMENTS

ISSUED BUT NOT YET ADOPTED

Fair Value Measurements

On January 1, 2008, PG&E Corporation and the Utility

adopted the provisions of SFAS No. 157, “Fair Value

Measurements,” (“SFAS No. 157”), which defi nes fair value

measurements and implements a hierarchical disclosure.

SFAS No. 157 defi nes fair value as “the price that would

be received to sell an asset or paid to transfer a liability in

an orderly transaction between market participants at the

measurement date,” or the “exit price.” Accordingly, an entity

must now determine the fair value of an asset or liability

based on the assumptions that market participants would

use in pricing the asset or liability, not those of the reporting

entity itself. The identifi cation of market participant assump-

tions provides a basis for determining what inputs are to be

used for pricing each asset or liability. Additionally, SFAS

No. 157 establishes a fair value hierarchy which gives prece-

dence to fair value measurements calculated using observable

inputs to those using unobservable inputs. Accordingly, the

following levels were established for each input:

• Level 1 — “Inputs that are quoted prices (unadjusted) in

active markets for identical assets or liabilities that the

reporting entity has the ability to access at the measure-

ment date.”

• Level 2 — “Inputs other than quoted prices included in

Level 1 that are observable for the asset or liability, either

directly or indirectly.”

• Level 3 — “Unobservable inputs for the asset or liability.”

These are inputs for which there is no market data avail-

able, or observable inputs that are adjusted using Level 3

assumptions.

SFAS No. 157 requires entities to disclose fi nancial fair-

valued instruments according to the above hierarchy in each

reporting period after implementation. The standard deferred

the disclosure of the hierarchy for certain non-fi nancial instru-

ments to fi scal years beginning after November 15, 2008.

SFAS No. 157 should be applied prospectively except if

certain criteria are met. Congestion Revenue Rights (“CRRs”)

held by the Utility meet the criteria and will be adjusted

upon adoption to comply with SFAS No. 157 requirements.

CRRs allow market participants, including load serving enti-

ties, to hedge the fi nancial risk of California Independent

System Operator (“CAISO”) imposed congestion charges in

the Market Redesign and Technology Upgrade (“MRTU”)

day-ahead market. PG&E Corporation and the Utility

are still evaluating the impact of the adjustment to price

risk management assets and regulatory liabilities on their

Consolidated Balance Sheets. The costs associated with pro-

curement of CRRs are currently being recovered in rates or

are probable of recovery in future rates; therefore, the adop-

tion of SFAS No. 157 will not have an impact on earnings.

Fair Value Option

In February 2007, the FASB issued SFAS No. 159, “The Fair

Value Option for Financial Assets and Financial Liabilities”

(“SFAS No. 159”). SFAS No. 159 establishes a fair value

option under which entities can elect to report certain

fi nancial assets and liabilities at fair value, with changes in

fair value recognized in earnings. SFAS No. 159 is effective

for fi scal years beginning after November 15, 2007. PG&E

Corporation and the Utility do not expect the adoption of

SFAS No. 159 to materially impact the fi nancial statements.

Amendment of FASB Interpretation No. 39

In April 2007, the FASB issued FASB Staff Position on

Interpretation 39, “Amendment of FASB Interpretation

No. 39” (“FIN 39-1”). Under FIN 39-1, a reporting entity

is permitted to offset the fair value amounts recognized for

cash collateral paid or cash collateral received against the fair

value amounts recognized for derivative instruments executed

with the same counterparty under a master netting arrange-

ment. FIN 39-1 is effective for fi scal years beginning after

November 15, 2007. PG&E Corporation and the Utility are

currently evaluating the impact of FIN 39-1.