PG&E 2007 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116

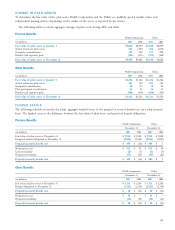

The following table provides a summary of the fair value, based on quoted market prices, of the investments held in the

Utility’s nuclear decommissioning trusts:

Total Total

Amortized Unrealized Unrealized Estimated

(in millions) Maturity Date Cost Gains Losses Fair Value(1)

Year ended December 31, 2007

U.S. government and agency issues 2008–2037 $ 767 $ 59 $— $ 826

Municipal bonds and other 2008–2049 209 5 — 214

Equity securities 464 682 (7) 1,139

Total $1,440 $746 $(7) $2,179

Year ended December 31, 2006

U.S. government and agency issues 2007–2036 $ 781 $ 34 $ (1) $ 814

Municipal bonds and other 2007–2049 252 7 (1) 258

Equity securities 347 644 — 991

Total $ 1,380 $ 685 $ (2) $ 2,063

(1) Excludes taxes on appreciation of investment value.

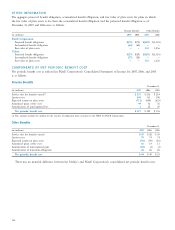

The cost of debt and equity securities sold is determined

by specifi c identifi cation. The following table provides a

summary of the activity for the debt and equity securities:

Year ended December 31,

(in millions) 2007 2006 2005

Proceeds received from sales

of securities $830 $1,087 $2,918

Gross realized gains on sales of

securities held as available-for-sale 61 55 56

Gross realized losses on sales of

securities held as available-for-sale (42) (29) (14)

SPENT NUCLEAR FUEL

STORAGE PROCEEDINGS

As part of the Nuclear Waste Policy Act of 1982, Congress

authorized the U.S. Department of Energy (“DOE”) and elec-

tric utilities with commercial nuclear power plants to enter

into contracts under which the DOE would be required to

dispose of the utilities’ spent nuclear fuel and high-level

radioactive waste no later than January 31, 1998, in exchange

for fees paid by the utilities. In 1983, the DOE entered into

a contract with the Utility to dispose of nuclear waste from

the Utility’s two nuclear generating units at Diablo Canyon

and its retired nuclear facility at Humboldt Bay. The DOE

failed to develop a permanent storage site by January 31,

1998. The Utility believes that the existing spent fuel pools at

Diablo Canyon (which include newly constructed temporary

storage racks) have suffi cient capacity to enable the Utility to

operate Diablo Canyon until approximately 2010 for Unit 1

and 2011 for Unit 2.

Because the DOE failed to develop a permanent storage

site, the Utility obtained a permit from the NRC to build

an on-site dry cask storage facility to store spent fuel through

at least 2024. After various parties appealed the NRC’s issu-

ance of the permit, the U.S. Court of Appeals for the Ninth

Circuit issued a decision in 2006 requiring the NRC to

issue a supplemental environmental assessment report on

the potential environmental consequences in the event of a

terrorist attack at Diablo Canyon, as well as to review other

contentions raised by the appealing parties related to poten-

tial terrorism threats. In August 2007, the NRC staff issued

a fi nal supplemental environmental assessment report con-

cluding there would be no signifi cant environmental impacts

from potential terrorist acts directed at the Diablo Canyon

storage facility. On January 15, 2008, the NRC decided to

hold hearings on whether it provided a complete list of the

references upon which it relied to fi nd that there would not

be a signifi cant environmental impact and whether it suffi -

ciently addressed the impacts on land and the local economy

of a potential terrorist attack. It is expected that the NRC

will issue a fi nal decision in the third quarter of 2008.

The Utility expects to complete the dry cask storage

facility and begin loading spent fuel in 2008. If the Utility

is unable to complete the dry cask storage facility, if opera-

tion of the facility is delayed beyond 2010, or if the Utility

is otherwise unable to increase its on-site storage capacity,

it is possible that the operation of Diablo Canyon may

have to be curtailed or halted as early as 2010 with respect

to Unit 1 and 2011 with respect to Unit 2 and continued

until such time as additional safe storage for spent fuel

is made available.