PG&E 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

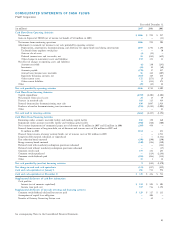

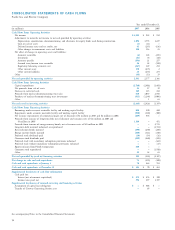

Year ended December 31,

(in millions) 2007 2006 2005

Cash Flows From Operating Activities

Net income $ 1,024 $ 985 $ 934

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation, amortization, decommissioning, and allowance for equity funds used during construction 1,892 1,755 1,697

Gain on sale of assets (1) (11) —

Deferred income taxes and tax credits, net 43 (287) (636)

Other changes in noncurrent assets and liabilities 188 116 21

Net effect of changes in operating assets and liabilities:

Accounts receivable (6) 128 (245)

Inventories (41) 34 (60)

Accounts payable (196) 21 257

Accrued taxes/income taxes receivable 56 28 (150)

Regulatory balancing accounts, net (567) 329 254

Other current assets 170 (273) 2

Other current liabilities 24 (235) 273

Other (45) (13) 19

Net cash provided by operating activities 2,541 2,577 2,366

Cash Flows From Investing Activities

Capital expenditures (2,768) (2,402) (1,803)

Net proceeds from sale of assets 21 17 39

Decrease in restricted cash 185 115 434

Proceeds from nuclear decommissioning trust sales 830 1,087 2,918

Purchases of nuclear decommissioning trust investments (933) (1,244) (3,008)

Other — 1 61

Net cash used in investing activities (2,665) (2,426) (1,359)

Cash Flows From Financing Activities

Borrowings under accounts receivable facility and working capital facility 850 350 260

Repayments under accounts receivable facility and working capital facility (900) (310) (300)

Net issuance (repayments) of commercial paper, net of discount of $1 million in 2007 and $2 million in 2006 (209) 458 —

Proceeds from issuance of long-term debt, net of discount and issuance costs of $16 million in 2007 and

$3 million in 2005 1,184 — 451

Proceeds from issuance of energy recovery bonds, net of issuance costs of $21 million in 2005 — — 2,711

Long-term debt matured, redeemed, or repurchased — — (1,554)

Rate reduction bonds matured (290) (290) (290)

Energy recovery bonds matured (340) (316) (140)

Preferred stock dividends paid (14) (14) (16)

Common stock dividends paid (509) (460) (445)

Preferred stock with mandatory redemption provisions redeemed — — (122)

Preferred stock without mandatory redemption provisions redeemed — — (37)

Equity infusion from PG&E Corporation 400 — —

Common stock repurchased — — (1,910)

Other 23 38 65

Net cash provided by (used in) fi nancing activities 195 (544) (1,327)

Net change in cash and cash equivalents 71 (393) (320)

Cash and cash equivalents at January 1 70 463 783

Cash and cash equivalents at December 31 $ 141 $ 70 $ 463

Supplemental disclosures of cash fl ow information

Cash paid for:

Interest (net of amounts capitalized) $ 474 $ 476 $ 390

Income taxes paid, net 594 897 1,397

Supplemental disclosures of noncash investing and fi nancing activities

Assumption of capital lease obligation $ — $ 408 $ —

Transfer of Gateway Generating Station asset — 69 —

CONSOLIDATED STATEMENTS OF CASH FLOWS

Pacifi c Gas and Electric Company

See accompanying Notes to the Consolidated Financial Statements.