PG&E 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

fair value can be made. In the same period, the associated

asset retirement costs are capitalized as part of the carrying

amount of the related long-lived asset. In each subsequent

period, the liability is accreted to its present value, and the

capitalized cost is depreciated over the useful life of the long-

lived asset. Rate-regulated entities may recognize regulatory

assets or liabilities as a result of timing differences between

the recognition of costs as recorded in accordance with

SFAS No. 143 and costs recovered through the ratemaking

process. FIN 47 clarifi es that if a legal obligation to perform

an asset retirement obligation exists but performance is

conditional upon a future event, and the obligation can be

reasonably estimated, then a liability should be recognized

in accordance with SFAS No. 143.

The Utility has identifi ed its nuclear generation and

certain fossil fuel generation facilities as having ARO

under SFAS No. 143. In accordance with FIN 47, the Utility

has identifi ed ARO related to asbestos contamination in

buildings, potential site restoration at certain hydroelectric

facilities, fuel storage tanks, and contractual obligations to

restore leased property to pre-lease condition. Additionally,

the Utility has recorded ARO related to the California Gas

Transmission pipeline, gas distribution, electric distribution,

and electric transmission system assets.

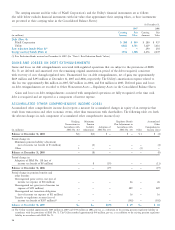

A reconciliation of the changes in the ARO liability is

as follows:

(in millions)

ARO liability at December 31, 2005 $1,587

Revision in estimated cash fl ows (204)

Accretion 98

Liabilities settled (15)

ARO liability at December 31, 2006 1,466

Revision in estimated cash fl ows 48

Accretion 95

Liabilities settled (30)

ARO liability at December 31, 2007 $1,579

The Utility has identifi ed additional ARO for which a

reasonable estimate of fair value could not be made. The

Utility has not recognized a liability related to these addi-

tional obligations, which include obligations to restore land

to its pre-use condition under the terms of certain land

rights agreements, removal and proper disposal of lead-based

paint contained in some Utility facilities, removal of cer-

tain communications equipment from leased property, and

retirement activities associated with substation and certain

hydroelectric facilities. The Utility was not able to reason-

ably estimate the asset retirement obligation associated with

these assets because the settlement date of the obligation

was indeterminate and information suffi cient to reasonably

estimate the settlement date or range of settlement dates does

not exist. Land rights, communication equipment leases,

and substation facilities will be maintained for the foresee-

able future, and the Utility cannot reasonably estimate

the settlement date or range of settlement dates for the

obligations associated with these assets. The Utility does

not have information available that specifi es which facilities

contain lead-based paint and, therefore, cannot reasonably

estimate the settlement date(s) associated with the obliga-

tion. The Utility will maintain and continue to operate its

hydroelectric facilities until operation of a facility becomes

uneconomic. The operation of the majority of the Utility’s

hydroelectric facilities is currently and for the foreseeable

future economic, and the settlement date cannot be deter-

mined at this time.

FAIR VALUE OF FINANCIAL INSTRUMENTS

The fair value of a fi nancial instrument represents the

amount at which the instrument could be exchanged in

a current transaction between willing parties, other than in a

forced sale or liquidation. The fair value may be signifi cantly

different than the carrying amount of fi nancial instruments

that are recorded at historical amounts.

PG&E Corporation and the Utility use the following

methods and assumptions in estimating fair value for

fi nancial instruments:

• The fair values of cash and cash equivalents, restricted cash

and deposits, net accounts receivable, price risk manage-

ment assets and liabilities, short-term borrowings, accounts

payable, customer deposits, and the Utility’s variable rate

pollution control bond loan agreements approximate their

carrying values as of December 31, 2007 and 2006.

• The fair values of the Utility’s fi xed rate senior notes, fi xed

rate pollution control bond loan agreements, and PG&E

Energy Recovery Funding LLC’s (“PERF”) energy recovery

bonds (“ERBs”) were based on quoted market prices

obtained from the Bloomberg fi nancial information

system at December 31, 2007.

• The estimated fair value of PG&E Corporation’s 9.50%

Convertible Subordinated debt was determined by con-

sidering the prices of securities displayed as of the close

of business on December 31, 2007 by a proprietary bond

trading system which tracks and marks a broad universe of

convertible securities including the securities being assessed.