PG&E 2007 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

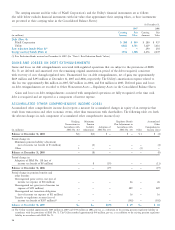

CREDIT FACILITIES AND SHORT-TERM BORROWINGS

The following table summarizes PG&E Corporation’s and the Utility’s short-term borrowings and outstanding credit facilities

at December 31, 2007:

(in millions) At December 31, 2007

Letters Commercial

Termination Facility of Credit Cash Paper

Authorized Borrower Facility Date Limit Outstanding Borrowings Backup Availability

PG&E Corporation Senior credit facility February 2012 $ 200(1) $ — $ — $ — $ 200

Utility Working capital facility February 2012 2,000(2) 165 250 270 1,315

Total credit facilities $2,200 $165 $250 $270 $1,515

(1) Includes $50 million sublimit for letters of credit and $100 million sublimit for swingline loans, which are made available on a same-day basis and

repayable in full within 30 days.

(2) Includes a $950 million sublimit for letters of credit and $100 million sublimit for swingline loans, which are made available on a same-day basis and

repayable in full within 30 days.

PG&E CORPORATION

Senior Credit Facility

PG&E Corporation has a $200 million revolving senior

unsecured credit facility (“senior credit facility”) with

a syndicate of lenders that expires on February 26, 2012.

Borrowings under the senior credit facility and letters

of credit may be used for working capital and other

corporate purposes. PG&E Corporation can, at any time,

repay amounts outstanding in whole or in part. At PG&E

Corporation’s request and at the sole discretion of each

lender, the senior credit facility may be extended for addi-

tional periods. PG&E Corporation has the right to increase,

in one or more requests given no more than once a year,

the aggregate facility by up to $100 million provided cer-

tain conditions are met. The fees and interest rates PG&E

Corporation pays under the senior credit facility vary

depending on the Utility’s unsecured debt ratings issued

by Standard & Poor’s Ratings Service (“S&P”) and Moody’s

Investors Service (“Moody’s”).

The senior credit facility includes usual and customary

covenants for credit facilities of this type, including cov-

enants limiting liens, mergers, sales of all or substantially

all of PG&E Corporation’s assets and other fundamental

changes. In general, the covenants, representations, and

events of default mirror those in the Utility’s working capital

facility, discussed below. In addition, the senior credit facil-

ity also requires that PG&E Corporation maintain a ratio of

total consolidated debt to total consolidated capitalization

of at most 65% and that PG&E Corporation own, directly

or indirectly, at least 80% of the common stock and at least

70% of the voting securities of the Utility.

At December 31, 2007, PG&E Corporation had no out-

standing borrowings or letters of credit under the senior

credit facility.

UTILITY

In the ordinary course of the Utility’s construction activities,

contractors who work on and provide materials to projects

may have certain statutory liens on such projects, which are

released as construction progresses and payments are made

for their work or materials.

Working Capital Facility

On February 26, 2007, the Utility increased its revolving

credit facility (“working capital facility”) with a syndicate

of lenders by $650 million to $2.0 billion and extended the

facility to February 26, 2012. The working capital facility

includes usual and customary covenants for credit facilities

of this type, including covenants limiting liens to those

permitted under the Senior Notes’ indenture, mergers, sales

of all or substantially all of the Utility’s assets and other

fundamental changes. In addition, the working capital

facility also requires that the Utility maintain a debt to

capitalization ratio of at most 65% as of the end of each

fi scal quarter. There were no material changes to the terms,

fees, interest rates, or covenants related to the working

capital facility as a result of the February 2007 amendment.