PG&E 2007 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124

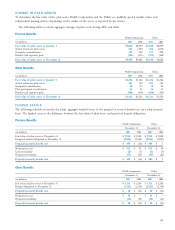

Benefi ts Payments

The estimated benefi ts expected to be paid in each of the

next fi ve fi scal years and in aggregate for the fi ve fi scal years

thereafter, are as follows:

PG&E

(in millions) Corporation Utility

Pension

2008 $ 426 $ 424

2009 456 453

2010 485 483

2011 514 512

2012 544 541

2013–2017 3,179 3,164

Other benefi ts

2008 $ 92 $ 92

2009 95 95

2010 96 96

2011 98 98

2012 98 98

2013–2017 516 516

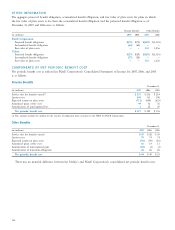

DEFINED CONTRIBUTION BENEFIT PLANS

PG&E Corporation and its subsidiaries also sponsor defi ned

contribution benefi t plans. These plans are qualifi ed under

applicable sections of the Internal Revenue Code. These

plans provide for tax-deferred salary deductions and after-tax

employee contributions as well as employer contributions.

Employees designate the funds in which their contributions

and any employer contributions are invested. Before April 1,

2007, PG&E Corporation employees received matching of

up to 5% of the employee’s base compensation and/or basic

contributions of up to 5% of the employee’s base compensa-

tion. Matching contributions vary up to 6% based on years

of service for Utility employees. Beginning April 1, 2007,

the basic employer contribution was discontinued for PG&E

Corporation employees and matching contributions were

changed to match the Utility employee plan. Employees may

reallocate matching employer contributions and accumulated

earnings thereon to another investment fund or funds avail-

able to the plan at any time after they have been credited

to the employee’s account. Employer contribution expense

refl ected in PG&E Corporation’s Consolidated Statements

of Income amounted to:

PG&E

(in millions) Corporation Utility

Year ended December 31,

2007 $47 $46

2006 45 43

2005 43 42

PG&E Corporation Supplemental

Retirement Savings Plan

The PG&E Corporation Supplemental Retirement Savings

Plan (“SRSP”) is a non-qualifi ed plan that allows eligible

offi cers and key employees of PG&E Corporation and its

subsidiaries to defer 5% to 50% of their base salary and all

or part of their incentive awards. In addition, to the extent

that matching employer contributions cannot be made to

a participant under the qualifi ed defi ned contribution benefi t

plan because the contributions would exceed the limitations

set by the Internal Revenue Code, PG&E Corporation

credits the excess amount to an SRSP account for the eligible

employee. Each SRSP participant has a separate account

which is adjusted on a quarterly basis to refl ect the perfor-

mance of the investment options selected by the participant.

The change in the value of participants’ accounts is recorded

as additional compensation expense or income in the

Consolidated Financial Statements. Total compensation

expense recognized by PG&E Corporation and the Utility

in connection with the plan amounted to:

PG&E

(in millions) Corporation Utility

Year ended December 31,

2007 $2 $1

2006 4 2

2005 3 1

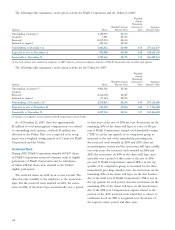

LONG-TERM INCENTIVE PLAN

The 2006 LTIP permits the award of various forms of

incentive awards, including stock options, stock appreciation

rights, restricted stock awards, restricted stock units, perfor-

mance shares, performance units, deferred compensation

awards, and other stock-based awards, to eligible employees

of PG&E Corporation and its subsidiaries. Non-employee

directors of PG&E Corporation are also eligible to receive

restricted stock and either stock options or restricted

stock units under the formula grant provisions of the

2006 LTIP. A maximum of 12 million shares of PG&E

Corporation common stock (subject to adjustment for

changes in capital structure, stock dividends, or other

similar events) have been reserved for issuance under the

2006 LTIP, of which 10,847,999 shares were available for

award at December 31, 2007.