PG&E 2007 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.128

The Bankruptcy Court retains jurisdiction over the

Utility’s escrowed funds (in addition, the Bankruptcy Court

retains jurisdiction to hear and determine disputes arising

in connection with the interpretation, implementation, or

enforcement of (1) the Chapter 11 Settlement Agreement,

(2) the Utility’s plan of reorganization under Chapter 11,

and (3) the Bankruptcy Court’s order confi rming the plan

of reorganization).

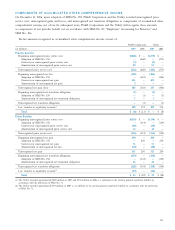

The Utility has entered into a number of settlements with

various electricity suppliers resolving some of these Disputed

Claims and the Utility’s refund claims against these electric-

ity suppliers. The Bankruptcy Court has approved the release

of $0.8 billion from escrow in connection with these settle-

ments. Through December 31, 2007, the Utility has received

consideration of approximately $1.2 billion under these

settlements through cash proceeds, reductions to the Utility’s

PX liability, and the acquisition of Gateway. These settlement

agreements provide that the amounts payable by the par-

ties are, in some instances, subject to adjustment based on

the outcome of the various refund offset and interest issues

being considered by the FERC.

During 2007, the Utility received approximately $79 mil-

lion (including interest) in cash-equivalent reductions to

the Utility’s PX liability from fi ve settlements approved

by the FERC. The Utility also received two cash distributions

in 2007 related to a prior settlement, totaling approximately

$34 million. These distributions will be refunded to cus-

tomers through rates. On December 21, 2007, the Utility

requested FERC approval of another settlement, under

which, if approved, the Utility would receive $45 million

in cash-equivalent reductions to its PX liability. Additional

settlement discussions with other electricity suppliers are

ongoing. Any net refunds, claim offsets, or other credits that

the Utility receives from energy suppliers through resolution

of the remaining Disputed Claims, either through settlement

or the conclusion of the various FERC and judicial proceed-

ings, will be credited to customers (after deductions for con-

tingencies based on the outcome of the various refund offset

and interest issues being considered by the FERC).

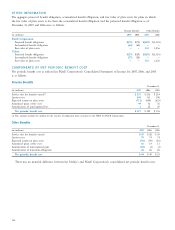

As of December 31, 2007, the amount of the accrual

for remaining net Disputed Claims was approximately

$1.1 billion, consisting of approximately $1.6 billion of

accounts payable Disputed Claims primarily payable to the

CAISO and the PX, offset by an accounts receivable from

the CAISO and the PX of approximately $0.5 billion. The

Utility held $1.2 billion (including interest) in escrow as

of December 31, 2007 for payment of the remaining net

Disputed Claims. The amount held in escrow is classifi ed

as Restricted Cash in the Consolidated Balance Sheets.

As of December 31, 2007, interest on the net Disputed

Claims balance, calculated at the FERC-ordered interest

rate, amounts to approximately $581 million (classifi ed as

Interest Payable in the Consolidated Balance Sheets). The

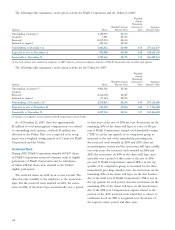

rate of interest actually earned by the Utility on the escrowed

amounts, however, is less than the FERC-ordered interest

rate. The Utility has been collecting the difference between

the earned amount and the accrued amount from custom-

ers. The amounts that have been collected from customers

to address the difference between FERC-ordered and actual

earned interest rates are not held in escrow. If the amount

of interest accrued at the FERC-ordered rate is greater than

the amount of interest ultimately determined to be owed to

generators, the Utility would refund to customers any excess

net interest collected from customers. The ultimate amount

of any interest that the Utility may be required to pay will

depend on the fi nal amount of refunds determined to be

owed to the Utility.

PG&E Corporation and the Utility are unable to predict

when the FERC or judicial proceedings will ultimately be

resolved, and the amount of any potential refunds that the

Utility may receive or the amount of Disputed Claims,

including interest, the Utility will be required to pay.

NOTE 16: RELATED

PARTY AGREEMENTS

AND TRANSACTIONS

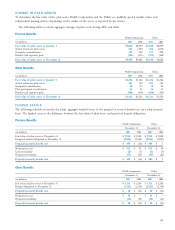

In accordance with various agreements, the Utility and other

subsidiaries provide and receive various services to and from

their parent, PG&E Corporation, and among themselves.

The Utility and PG&E Corporation exchange administrative

and professional services in support of operations. Services

are priced at their fully loaded costs (i.e., direct cost of good

or service plus all applicable indirect charges and overheads).

PG&E Corporation also allocates various corporate adminis-

trative and general costs to the Utility and other subsidiaries