PG&E 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

Financing Activities

The Utility’s cash fl ows from fi nancing activities for 2007,

2006, and 2005 were as follows:

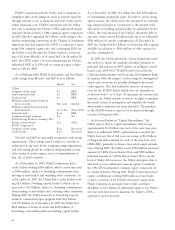

(in millions) 2007 2006 2005

Borrowings under accounts receivable

facility and working capital facility $ 850 $ 350 $ 260

Repayments under accounts receivable

facility and working capital facility (900) (310) (300)

Net issuance (repayments) of

commercial paper, net of discount

of $1 million in 2007 and

$2 million in 2006 (209) 458 —

Net proceeds from issuance of

long-term debt 1,184 — 451

Net proceeds from issuance of

energy recovery bonds — — 2,711

Long-term debt, matured, redeemed,

or repurchased — — (1,554)

Rate reduction bonds matured (290) (290) (290)

Energy recovery bonds matured (340) (316) (140)

Preferred stock dividends paid (14) (14) (16)

Common stock dividends paid (509) (460) (445)

Preferred stock with mandatory

redemption provisions redeemed — — (122)

Preferred stock without mandatory

redemption provisions redeemed — — (37)

Equity infusion from

PG&E Corporation 400 — —

Common stock repurchased — — (1,910)

Other 23 38 65

Net cash provided by (used in)

fi nancing activities $ 195 $(544) $(1,327)

In 2007, net cash provided by fi nancing activities

increased by approximately $739 million compared to 2006.

This was mainly due to the following factors:

• The Utility issued Senior Notes in March and December

2007 for net proceeds of approximately $690 million

and $494 million, respectively, with no similar issuances

in 2006.

• The Utility received equity infusions of $400 million from

PG&E Corporation in 2007, with no similar infusions

in 2006.

• The Utility borrowed $500 million more under its working

capital facility in 2007 as compared to 2006.

• The Utility repaid $590 million more under its working

capital and accounts receivable facilities in 2007 as com-

pared to 2006.

• The Utility made net commercial paper repayments of

approximately $209 million in 2007 as compared to

net borrowings of $458 million in 2006.

• The Utility paid approximately $49 million more in

common stock dividends in 2007 than in 2006.

In 2006, net cash used in fi nancing activities decreased

by approximately $783 million compared to 2005. This was

mainly due to the following factors:

• The Utility had net issuances of $458 million in commer-

cial paper in 2006 with no similar issuance in 2005.

• In 2005, the Utility repurchased $1.9 billion in com-

mon stock from PG&E Corporation. There were no

common stock repurchases in 2006.

• The Utility received proceeds of $2.7 billion from the

issuance of ERBs in 2005.

• In May 2005, the Utility borrowed $451 million from

the California Infrastructure and Economic Development

Bank, which was funded by the bank’s issuance of

Pollution Control Bonds Series A-G, with no similar

borrowing in 2006.

• The amount of ERBs that matured in 2006 was approxi-

mately $175 million greater than the amount that matured

in 2005.

• The Utility borrowed $90 million more from the accounts

receivable facility during 2006, as compared to 2005.

• The Utility redeemed $122 million of preferred stock in

2005 with no similar redemption in 2006.

• In 2005, the Utility redeemed $500 million and defeased

$600 million of Floating Rate First Mortgage Bonds

(redesignated as Senior Notes in April 2005). The Utility

also repaid $454 million under certain reimbursement

obligations that the Utility entered into in April 2004,

when its plan of reorganization under Chapter 11 of the

U.S. Bankruptcy Code became effective. There were no

similar redemptions or repayments in 2006.

PG&E CORPORATION

Operating Activities

PG&E Corporation’s consolidated cash fl ows from

operating activities consist mainly of billings to the

Utility for services rendered and payments for employee

compensation and goods and services provided by others

to PG&E Corporation. PG&E Corporation also incurs

interest costs associated with its debt.