PG&E 2007 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

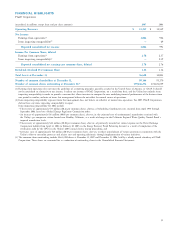

coordinator (“SC”) costs that the Utility began incurring

in 1998 (representing a $77 million decrease in net income

as compared to 2006), (2) the recovery of certain interest

and litigation costs following the CPUC’s completion of

a verifi cation audit (representing a $39 million decrease in

net income as compared to 2006), and (3) a decrease in the

amount accrued for long-term disability benefi ts and a tax

benefi t recognized in 2006 related to a tax loss carry forward

(representing a $26 million decrease in net income as com-

pared to 2006).

KEY FACTORS AFFECTING RESULTS OF

OPERATIONS AND FINANCIAL CONDITION

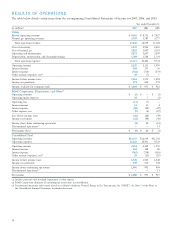

PG&E Corporation and the Utility’s results of operations

and fi nancial condition depend primarily on whether the

Utility is able to operate its business within authorized

revenue requirements, timely recover its authorized costs,

and earn its authorized rate of return. A number of factors

have had, or are expected to have, a signifi cant impact on

PG&E Corporation’s and the Utility’s results of operations

and fi nancial condition, including:

• The Outcome of Regulatory Proceedings — The amount

of the Utility’s revenues and the amount of costs that the

Utility is authorized to recover from customers are prima-

rily determined through regulatory proceedings. The timing

of CPUC and FERC decisions also affect when the Utility

is able to record the authorized revenues. In March 2007,

the CPUC issued a decision in the 2007 GRC, effective

January 1, 2007, establishing a $4.9 billion annual rev-

enue requirement for the Utility’s electric and natural gas

distribution operations and its electric generation opera-

tions for 2007 through 2010, with authorized increases

in each of 2008, 2009, and 2010. In June 2007, the FERC

approved the Utility’s annual electric transmission retail

revenue requirement at $674 million, effective March 1,

2007. In addition, in September 2007, the FERC accepted

the Utility’s proposed electric transmission retail revenue

requirement effective March 1, 2008, subject to hearing

and refund, an amount that would represent a revenue

increase of approximately $78 million over March 1, 2007

rates. In September 2007, the CPUC approved a multi-

party settlement agreement (known as the Gas Accord IV)

that establishes the Utility’s natural gas transmission and

storage rates and associated revenue requirements for 2008

through 2010, with 2008 rates set at $446 million with

slight escalations in each subsequent year. Finally,

during 2007, the CPUC established incentive ratemaking

mechanisms applicable to the California investor-owned

utilities’ implementation of their energy effi ciency pro-

grams funded for the 2006–2008 and 2009–2011 program

cycles. The maximum amount of incentives that the

Utility could earn (and the maximum amount that

the Utility could be required to reimburse customers)

over the 2006–2008 program cycle is $180 million. The

actual amount and timing of the fi nancial impact will

depend on the level of energy effi ciency savings actually

achieved over the three-year program cycle, the amount of

the savings attributable to the Utility’s energy effi ciency

programs, and when the applicable accounting standard

for recognizing incentives or reimbursement obligations is

met. The outcome of various other pending regulatory pro-

ceedings also could have a material effect on the Utility’s

results of operations. (See “Regulatory Matters” below.)

• Capital Structure and Return on Common Equity — In 2007,

the CPUC authorized the Utility to earn a ROE of 11.35%

on its electric and natural gas distribution and electric

generation rate base and to maintain an authorized capital

structure that included a 52% common equity component.

On December 20, 2007, the CPUC authorized the Utility

to earn the same ROE and maintain the same capital

structure in 2008. In December 2007, Moody’s Investors

Service (“Moody’s”) upgraded the Utility’s credit rating

to A3, thereby terminating a provision in the December

2003 settlement agreement among PG&E Corporation,

the Utility, and the CPUC to resolve the Utility’s pro-

ceeding under Chapter 11 of the U.S. Bankruptcy Code

(“Chapter 11 Settlement Agreement”) that had required

the CPUC to authorize a minimum ROE for the Utility

of 11.22% and a minimum common equity component of

52% until the Utility received a credit rating of “A3” from

Moody’s or “A-” from Standard & Poor’s Ratings Service

(“S&P”). (See “Liquidity and Financial Resources” below.)