PG&E 2007 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.117

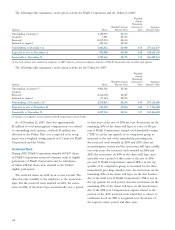

The Utility and other nuclear power plant owners have

sued the DOE for breach of contract. The Utility seeks to

recover its costs to develop on-site storage at Diablo Canyon

and Humboldt Bay Unit 3. In October 2006, the U.S. Court

of Federal Claims found the DOE had breached its contract

and awarded the Utility approximately $42.8 million of

the $92 million incurred by the Utility through 2004. The

Utility appealed to the U.S. Court of Appeals for the Federal

Circuit seeking to increase the amount of the award and

challenged the U.S. Court of Federal Claims’ fi nding that

the Utility would have incurred some of the costs for the

on-site storage facilities even if the DOE had complied with

the contract. A decision on the appeal is expected by the

end of 2008. The Utility will seek to recover costs incurred

after 2004 in future lawsuits against the DOE. Any amounts

recovered from the DOE will be credited to customers

through rates.

PG&E Corporation and the Utility are unable to predict

the outcome of this appeal or the amount of any additional

awards the Utility may receive. If the U.S. Court of Federal

Claims’ decision is not overturned or modifi ed on appeal,

it is likely that the Utility will be unable to recover all of

its future costs for on-site storage facilities from the DOE.

However, reasonably incurred costs related to the on-site

storage facilities are, in the case of Diablo Canyon, recover-

able through rates and, in the case of Humboldt Bay Unit 3,

recoverable through its decommissioning trust fund.

NOTE 14: EMPLOYEE

COMPENSATION PLANS

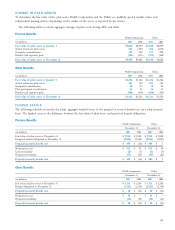

PG&E Corporation and its subsidiaries provide non-

contributory defi ned benefi t pension plans for certain

employees and retirees, referred to collectively as pension

benefi ts. PG&E Corporation and the Utility have elected

that certain of the trusts underlying these plans be treated

under the Internal Revenue Code as qualifi ed trusts. If

certain conditions are met, PG&E Corporation and the

Utility can deduct payments made to the qualifi ed trusts,

subject to certain Internal Revenue Code limitations. PG&E

Corporation and its subsidiaries also provide contributory

defi ned benefi t medical plans for certain retired employees

and their eligible dependents, and non-contributory defi ned

benefi t life insurance plans for certain retired employees

(referred to collectively as other benefi ts). The following

schedules aggregate all of PG&E Corporation’s and the

Utility’s plans and are presented based on the sponsor

of each plan. PG&E Corporation and its subsidiaries use

a December 31 measurement date for all of their plans.

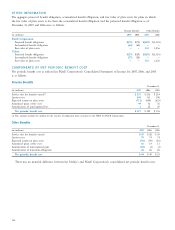

Under SFAS No. 71, regulatory adjustments are recorded

in the Consolidated Statements of Income and Consolidated

Balance Sheets of the Utility to refl ect the difference between

Utility pension expense or income for accounting purposes

and Utility pension expense or income for ratemaking,

which is based on a funding approach. Only the portion of

the pension contribution allocated to the gas transmission

and storage business is not recoverable in rates. For 2007,

the reduction in net income as a result of the Utility not

being able to recover this portion in rates was approximately

$3 million, net of tax. A regulatory adjustment is also

recorded for the amounts that would otherwise be charged

to accumulated other comprehensive income under SFAS

No. 158, “Employers’ Accounting for Defi ned Benefi t

Pension and Other Postretirement Plans” (“SFAS No. 158”)

for the pension benefi ts related to the Utility’s qualifi ed

benefi t pension plan. Since 1993, the CPUC has authorized

the Utility to recover the costs associated with its other ben-

efi ts based on the lesser of the expense under SFAS No. 106,

“Employers’ Accounting for Postretirement Benefi ts Other

Than Pensions” (“SFAS No. 106”), or the annual tax deduct-

ible contributions to the appropriate trusts. This recovery

mechanism does not allow the Utility to record a regulatory

asset for the SFAS No. 158 charge to accumulated other com-

prehensive income related to other benefi ts. However, the

Utility is not precluded from recording a regulatory liability

as was done in 2007.