PG&E 2007 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

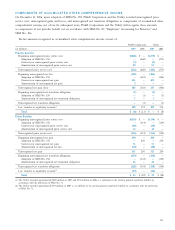

At December 31, 2007, the undiscounted future expected power purchase agreement payments were as follows:

Irrigation District &

Qualifying Facility Water Agency Renewable Other

Operations & Debt

(in millions) Energy Capacity Maintenance Service Energy Capacity Energy Capacity

2008 $ 1,306 $ 464 $ 57 $ 26 $ 231 $14 $ 6 $232

2009 1,277 423 49 26 308 11 9 210

2010 1,159 389 67 22 346 7 8 159

2011 1,141 376 35 21 488 7 8 45

2012 1,029 345 30 21 524 7 8 18

Thereafter 7,063 2,213 72 53 6,840 — 11 2

Total $12,975 $4,210 $310 $169 $8,737 $46 $50 $666

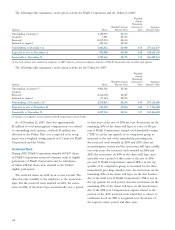

The following table shows the future fi xed capacity pay-

ments due under the QF contracts that are treated as capital

leases. These amounts are also included in the table above.

The fi xed capacity payments are discounted to the present

value shown in the table below using the Utility’s incremen-

tal borrowing rate at the inception of the leases. The amount

of this discount is shown in the table below as the amount

representing interest:

(in millions)

2008 $ 50

2009 50

2010 50

2011 50

2012 50

Thereafter 253

Total fi xed capacity payments 503

Amount representing interest 131

Present value of fi xed capacity payments $372

Interest and amortization expense associated with

the lease obligation is included in the cost of electricity

on PG&E Corporation’s and the Utility’s Consolidated

Statements of Income. In accordance with SFAS No. 71, the

timing of the Utility’s capacity payments will conform to

the ratemaking treatment for the Utility’s recovery of the

cost of electricity. The QF contracts that are treated as capital

leases expire between April 2014 and September 2021.

The Utility’s Consolidated Balance Sheet has included

in Current Liabilities — Other and Noncurrent Liabilities —

Other approximately $28 million and $344 million, respec-

tively, as of December 31, 2007, representing the present

value of the fi xed capacity payments due under these con-

tracts. The corresponding assets of $372 million, including

amortization of $36 million, are included in property, plant,

and equipment on the Utility’s Consolidated Balance Sheet

at December 31, 2007.

Natural Gas Supply and Transportation Commitments

The Utility purchases natural gas directly from producers and

marketers in both Canada and the United States to serve its

core customers. The contract lengths and natural gas sources

of the Utility’s portfolio of natural gas procurement contracts

have fl uctuated generally based on market conditions.

At December 31, 2007, the Utility’s undiscounted obliga-

tions for natural gas purchases and gas transportation services

were as follows:

(in millions)

2008 $1,181

2009 222

2010 22

2011 14

2012 7

Thereafter —

Total $1,446

Payments for natural gas purchases and gas transportation

services amounted to approximately $2.2 billion in 2007,

$2.2 billion in 2006, and $2.5 billion in 2005.

Nuclear Fuel Agreements

The Utility has entered into several purchase agreements for

nuclear fuel. These agreements have terms ranging from one

to thirteen years and are intended to ensure long-term fuel

supply. The contracts for uranium and conversion services

provide for 100% coverage of reactor requirements through

2010, while contracts for enrichment services provide for

100% coverage of reactor requirements through 2009. The

Utility relies on a number of international producers of

nuclear fuel in order to diversify its sources and provide

security of supply. Pricing terms also are diversifi ed, ranging

from market-based prices to base prices that are escalated

using published indices. New agreements are primarily based

on forward market pricing and will begin to impact nuclear

fuel costs starting in 2010.