PG&E 2007 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114

Derivative instruments may be designated as cash fl ow

hedges when they hedge variable price risk associated with

the purchase of commodities. Cash fl ow hedges are presented

on a net basis by counterparty.

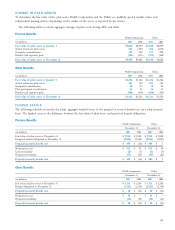

The table below represents the portion of the derivative

balances that were designated as cash fl ow hedges:

Cash Flow Hedges

December 31, December 31,

(in millions) 2007 2006

Current Assets — Prepaid expenses

and other(1) $ (2) $ 3

Other Noncurrent Assets — Other 33 8

Current Liabilities — Other 19 25

Noncurrent Liabilities — Other 3 —

(1) $2 million of the cash fl ow hedges in a liability position at December 31,

2007 relate to counterparties for which the total net derivatives position

is a current asset.

The Utility also has derivative instruments for the

physical delivery of commodities transacted in the normal

course of business as well as non-fi nancial assets that are

not exchange-traded. These derivative instruments are eligible

for the normal purchase and sales and non-exchange traded

contract exceptions under SFAS No. 133, and are not refl ected

on the Consolidated Balance Sheets. They are recorded and

recognized in income using accrual accounting. Therefore,

expenses are recognized in cost of electricity and cost of

natural gas as incurred.

Net realized gains or losses on derivative instruments

are included in various items on PG&E Corporation’s and

the Utility’s Consolidated Statements of Income, including

cost of electricity and cost of natural gas. Cash infl ows and

outfl ows associated with the settlement of price risk man-

agement activities are recognized in operating cash fl ows

on PG&E Corporation’s and the Utility’s Consolidated

Statements of Cash Flows.

The dividend participation rights associated with PG&E

Corporation’s Convertible Subordinated Notes are recorded

at fair value in PG&E Corporation’s Consolidated Financial

Statements in accordance with SFAS No. 133. (See Note 4

above for discussion of the Convertible Subordinated Notes.)

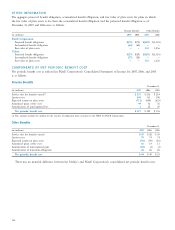

NOTE 13: NUCLEAR

DECOMMISSIONING

The Utility’s nuclear power facilities consist of two units

at Diablo Canyon (“Diablo Canyon Unit 1” and “Diablo

Canyon Unit 2”) and the retired facility at Humboldt Bay

(“Humboldt Bay Unit 3”). Nuclear decommissioning requires

the safe removal of nuclear facilities from service and the

reduction of residual radioactivity to a level that permits

termination of the Nuclear Regulatory Commission (“NRC”)

license and release of the property for unrestricted use. The

Utility makes contributions to trust funds (described below)

to provide for the eventual decommissioning of each nuclear

unit. In the Utility’s 2005 Nuclear Decommissioning Cost

Triennial Proceeding (“NDCTP”), used to determine the level

of Utility trust contributions and related revenue require-

ment, the CPUC assumed that the eventual decommission-

ing of Diablo Canyon Unit 1 would be scheduled to begin

in 2024 and be completed in 2044; that decommissioning of

Diablo Canyon Unit 2 would be scheduled to begin in 2025

and be completed in 2041; and that decommissioning of

Humboldt Bay Unit 3 would be scheduled to begin in 2009

and be completed in 2015.

As presented in the Utility’s NDCTP, the estimated nuclear

decommissioning cost for Diablo Canyon Units 1 and 2 and

Humboldt Bay Unit 3 is approximately $2.19 billion in 2007

dollars (or approximately $5.42 billion in future dollars).

These estimates are based on the 2005 decommissioning cost

studies, prepared in accordance with CPUC requirements.

The Utility’s revenue requirements for nuclear decommis-

sioning costs (i.e., the revenue requirements used by the

Utility to make contributions to the decommissioning trust

funds) are recovered from customers through a non-bypassable

charge that the Utility expects will continue until those

costs are fully recovered. The decommissioning cost estimates

are based on the plant location and cost characteristics for

the Utility’s nuclear power plants. Actual decommissioning

costs may vary from these estimates as a result of changes

in assumptions such as decommissioning dates, regulatory

requirements, technology, and costs of labor, materials

and equipment.

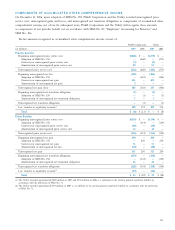

The estimated nuclear decommissioning cost described

above is used for regulatory purposes. However, under

GAAP requirements, the decommissioning cost estimate

is calculated using a different method in accordance with

SFAS No. 143. Under GAAP, the Utility adjusts its nuclear

decommissioning obligation to refl ect the fair value

of decommissioning its nuclear power facilities and records

this as an asset retirement obligation on its Consolidated