HP 2007 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

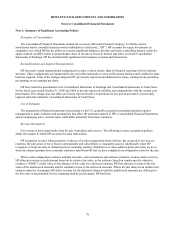

Note 1: Summary of Significant Accounting Policies (Continued)

Other Concentration

HP obtains a significant number of components from single source suppliers due to technology, availability, price,

quality or other considerations. The loss of a single source supplier, the deterioration of its relationship with a single source

supplier, or any unilateral modification to the contractual terms under which HP is supplied components by a single source

supplier could adversely effect HP’ s revenue and gross margins.

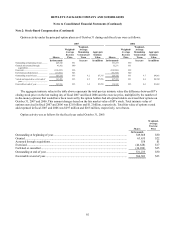

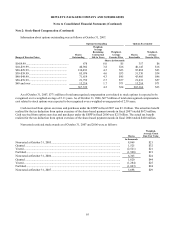

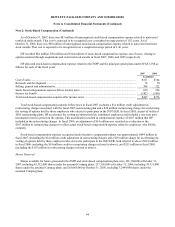

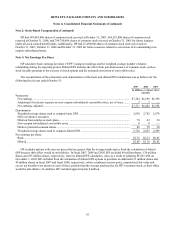

Stock-Based Compensation

Effective November 1, 2005, HP adopted the fair value recognition provisions of SFAS No. 123 (revised 2004),

“Share-Based Payment” (“SFAS 123R”), using the modified prospective transition method and therefore has not restated

results for prior periods. Under this transition method, stock-based compensation expense in fiscal 2006 included stock-based

compensation expense for all share-based payment awards granted prior to, but not yet vested as of November 1, 2005, based

on the grant-date fair value estimated in accordance with the original provision of SFAS No. 123, “Accounting for

Stock-Based Compensation” (“SFAS 123”). Stock-based compensation expense for all share-based payment awards granted

after November 1, 2005 is based on the grant-date fair value estimated in accordance with the provisions of SFAS 123R. HP

recognizes these compensation costs on a straight-line basis over the requisite service period of the award, which is generally

the option vesting term of four years. Prior to the adoption of SFAS 123R, HP recognized stock-based compensation expense

in accordance with Accounting Principles Board (“APB”) Opinion No. 25, “Accounting for Stock Issued to Employees”

(“APB 25”). In March 2005, the Securities and Exchange Commission (the “SEC”) issued Staff Accounting Bulletin No. 107

(“SAB 107”) regarding the SEC’ s interpretation of SFAS 123R and the valuation of share-based payments for public

companies. HP has applied the provisions of SAB 107 in its adoption of SFAS 123R.

In November 2005, the Financial Accounting Standards Board (“FASB”) issued FASB Staff Position (“FSP”) No.

FAS 123(R)-3, “Transition Election Related to Accounting for Tax Effects of Share-Based Payment Awards” (“FSP 123R-

3”). HP has elected to adopt the alternative transition method provided in the FSP 123R-3 for calculating the tax effects of

stock-based compensation pursuant to SFAS 123R. The alternative transition method includes simplified methods to

establish the beginning balance of the additional paid-in capital pool (“APIC pool”) related to the tax effects of employee

stock-based compensation, and to determine the subsequent impact on the APIC pool and Consolidated Statements of Cash

Flows of the tax effects of employee stock-based compensation awards that are outstanding upon adoption of SFAS 123R.

See Note 2 to the Consolidated Financial Statements for a further discussion on stock-based compensation.

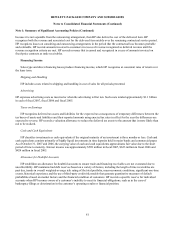

Foreign Currency Transactions

HP uses the U.S. dollar predominately as its functional currency. Assets and liabilities denominated in non-U.S. dollars

are remeasured into U.S. dollars at current exchange rates for monetary assets and liabilities, and historical exchange rates for

nonmonetary assets and liabilities. Net revenue, cost of sales and expenses are remeasured at average exchange rates in effect

during each period, except for those net revenue, cost of sales and expenses related to the previously noted balance sheet

amounts, which HP remeasures at historical exchange rates. HP includes gains or losses from foreign currency

remeasurement in net earnings. Certain foreign subsidiaries designate the local

85