HP 2007 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 15: Retirement and Post-Retirement Benefit Plans (Continued)

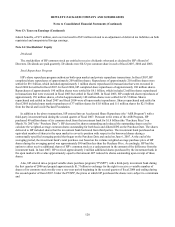

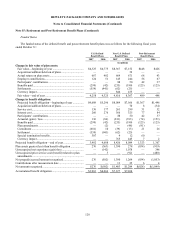

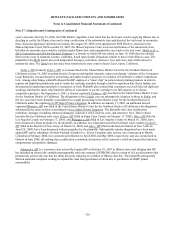

Defined benefit plans with projected benefit obligations exceeding the fair value of plan assets were as follows:

U.S. Defined

Benefit Plans

Non-U.S. Defined

Benefit Plans

2007 2006 2007 2006

In millions

Aggregate fair value of plan assets ..................................................................................... — $4,325 $422 $1,984

Aggregate projected benefit obligation............................................................................... $131 $4,688 $776 $2,411

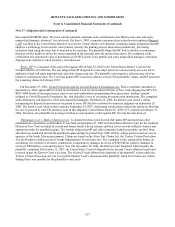

Defined benefit plans with accumulated benefit obligations exceeding the fair value of plan assets were as follows:

U.S. Defined

Benefit Plans

Non-U.S.

Defined

Benefit Plans

2007 2006 2007 2006

In millions

Aggregate fair value of plan assets .............................................................................................. — — $116 $350

Aggregate accumulated benefit obligation .................................................................................. $124 $146 $360 $586

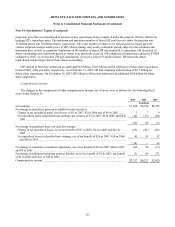

Plan Asset Allocations

HP’ s weighted-average target and asset allocations at the September 30 measurement date were as follows:

U. S. Defined

Benefit Plans

Non-U.S. Defined

Benefit Plans

Post-Retirement

Benefit Plans

2007

Target Plan Assets

2007

Target Plan Assets

2007

Target Plan Assets

Asset Category Allocation 2007 2006 Allocation 2007 2006 Allocation 2007 2006

Public equity securities .............. 62.5% 70.5% 62.1% 63.5% 64.3% 66.8%

Private equity securities............. 5.8% 3.4% — — 11.5% 8.6%

Real estate and other.................. 0.6% 0.3% 6.5% 2.6% 0.9% 0.7%

Equity-related investments ........ 70% 68.9% 74.2% 67% 68.6% 66.1% 76% 76.7% 76.1%

Public debt securities ................. 28% 28.0% 25.8% 33% 30.9% 33.4% 21% 20.5% 23.9%

Cash ........................................... 2%

3.1% — — 0.5% 0.5% 3% 2.8% —

Total........................................ 100% 100% 100% 100% 100.0% 100.0% 100% 100.0% 100.0%

Investment Policy

HP’ s investment strategy for worldwide plan assets is to seek a competitive rate of return relative to an appropriate level

of risk. The majority of the plans’ investment managers employ active investment management strategies with the goal of

outperforming the broad markets in which they invest. Risk management practices include diversification across asset classes

and investment styles and periodic rebalancing toward asset allocation targets. A number of the plans’ investment managers

are

130