HP 2007 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

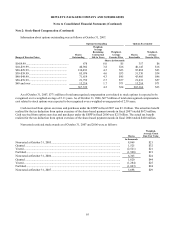

Note 2: Stock-Based Compensation (Continued)

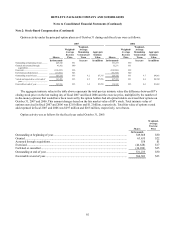

As of October 31, 2007, there was $83 million of unrecognized stock-based compensation expense related to nonvested

restricted stock awards. That cost is expected to be recognized over a weighted-average period of 1.02 years. As of

October 31, 2006, there was $90 million of unrecognized stock-based compensation expense related to nonvested restricted

stock awards. That cost is expected to be recognized over a weighted-average period of 1.46 years.

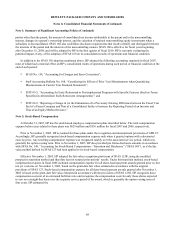

HP recorded $84 million, $58 million and $144 million of stock-based compensation expense, net of taxes, relating to

options assumed through acquisitions and restricted stock awards in fiscal 2007, 2006, and 2005 respectively.

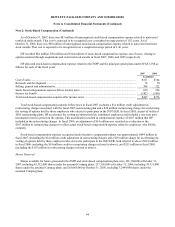

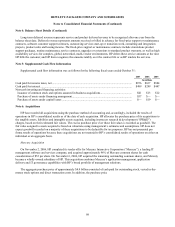

HP allocated stock-based compensation expense related to the ESPP and the principal option plans under SFAS 123R as

follows for each of the fiscal years:

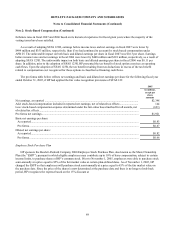

2007 2006

In millions

Cost of sales.................................................................................................................................................. $161 $144

Research and development ........................................................................................................................... 74 70

Selling, general and administrative............................................................................................................... 394 322

Stock-based compensation expense before income taxes............................................................................. 629 536

Income tax benefit ........................................................................................................................................ (182) (160)

Total stock-based compensation expense after income taxes ....................................................................... $447 $376

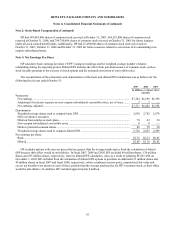

Total stock-based compensation expense before taxes in fiscal 2007 excludes a $14 million credit adjustment in

restructuring charges associated with the fiscal 2005 restructuring plan and a $29 million restructuring charge for accelerating

the vesting of options held by those employees who elected to participate in the 2007 EER. In fiscal 2005, as part of its fiscal

2005 restructuring plans, HP accelerated the vesting on options held by terminated employees and included a one-year post-

termination exercise period on the options. This modification resulted in compensation expense of $107 million that HP

included in the restructuring charges. In fiscal 2006, an adjustment of $14 million was recorded as a reduction to the

$107 million in restructuring charges to reflect actual stock-based compensation expense related to employees who left the

company.

Stock-based compensation expense recognized under incentive compensation plans was approximately $644 million in

fiscal 2007 (including the $14 million credit adjustment in restructuring charges and a $29 million charge for accelerating the

vesting of options held by those employees who elected to participate in the 2007 EER, both referred to above) $522 million

in fiscal 2006 (including the $14 million credit in restructuring charges referred to above), and $211 million in fiscal 2005

(including the $107 million in restructuring charges referred to above).

Shares Reserved

Shares available for future grant under the ESPP and stock-based compensation plans were 181,704,000 at October 31,

2007, including 45,312,000 shares under the assumed Compaq plans; 217,556,000 at October 31, 2006, including 39,151,000

shares under the assumed Compaq plans; and 260,669,000 at October 31, 2005, including 32,449,000 shares under the

assumed Compaq plans.

94