HP 2007 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

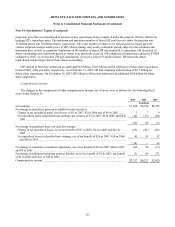

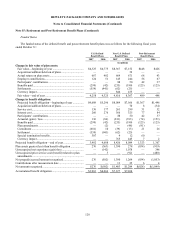

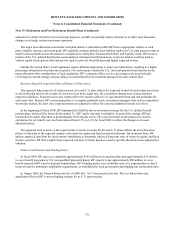

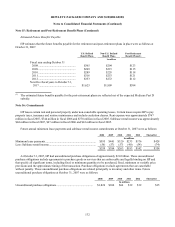

Note 15: Retirement and Post-Retirement Benefit Plans (Continued)

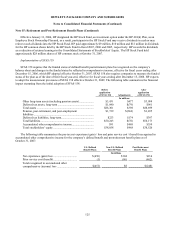

Funded Status

The funded status of the defined benefit and post-retirement benefit plans was as follows for the following fiscal years

ended October 31:

U.S. Defined

Benefit Plans

Non-U.S. Defined

Benefit Plans

Post-Retirement

Benefit Plans

2007 2006 2007 2006 2007 2006

In millions

Change in fair value of plan assets:

Fair value—beginning of year ........................................... $4,325 $4,775 $8,367 $7,152 $448 $426

Acquisition/addition/deletion of plans............................... ———39 — —

Actual return on plan assets ............................................... 667 482 669 671 68 43

Employer contributions...................................................... 124 51 145 244 56 67

Participants’ contributions ................................................. — — 88 50 42 37

Benefits paid ...................................................................... (299) (42) (235) (199) (125) (125)

Settlements......................................................................... (559) (941) (62) (25) — —

Currency impact................................................................. — —844 435 — —

Fair value—end of year ..................................................... 4,258 4,325 9,816 8,367 489 448

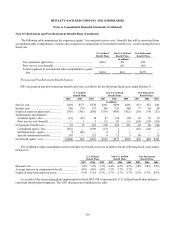

Change in benefit obligation:

Projected benefit obligation—beginning of year ............... $4,688 $5,296 $8,089 $7,566 $1,367 $1,496

Acquisition/addition/deletion of plans............................... ———70 8 (34)

Service cost........................................................................ 130 177 261 299 31 32

Interest cost........................................................................ 260 276 366 325 77 84

Participants’ contributions ................................................. — — 88 50 42 37

Actuarial (gain) / loss......................................................... 136 (86) (811) (393) (74) (151)

Benefits paid ...................................................................... (299) (42) (235) (199) (125) (125)

Plan amendments ............................................................... — (2) — (48) (91) —

Curtailment ........................................................................ (681) 10 (39) (13) 21 26

Settlement .......................................................................... (559) (941) (62) (25) — —

Special termination benefits............................................... 307 — 4 12 60 —

Currency impact................................................................. — —765 445 7 2

Projected benefit obligation—end of year ............................ 3,982 4,688 8,426 8,089 1,323 1,367

Plan assets greater (less) than benefit obligation .................. 276 (363) 1,390 278 (834) (919)

Unrecognized net experience (gain) loss .............................. — (142) — 1,078 — 346

Unrecognized prior service cost (benefit) related to plan

amendments .......................................................................

—3 — (92) —(480)

Net prepaid (accrued) amount recognized ............................ 276 (502) 1,390 1,264 (834) (1,053)

Contributions after measurement date .................................. — —13 25 6 4

Net amount recognized ......................................................... $276 $(502) $1,403 $1,289 $(828) $(1,049)

Accumulated benefit obligation............................................ $3,963 $4,066 $7,677 $7,264

128