HP 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 1: Summary of Significant Accounting Policies (Continued)

currency as their functional currency, and HP records the translation of their assets and liabilities into U.S. dollars at the

balance sheet dates as translation adjustments and includes them as a component of accumulated other comprehensive

income (loss).

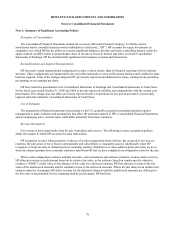

Retirement and Post-Retirement Plans

HP has various defined benefit, other contributory and noncontributory retirement and post-retirement plans. HP

generally amortizes unrecognized actuarial gains and losses on a straight-line basis over the remaining estimated service life

of participants. The measurement date for all plans is September 30 for fiscal 2007 and fiscal 2006. See Note 15 for a full

description of these plans and the accounting and funding policies, which is incorporated herein by reference.

Recent Pronouncements

In July 2006, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation No. 48, “Accounting for

Uncertainty in Income Taxes, an interpretation of FASB Statement No. 109” (“FIN 48”). FIN 48 clarifies the accounting for

uncertainty in income taxes by prescribing the recognition threshold a tax position is required to meet before being

recognized in the financial statements. It also provides guidance on derecognition, classification, interest and penalties,

accounting in interim periods, disclosure and transition. FIN 48 is effective for fiscal years beginning after December 15,

2006 and is required to be adopted by HP in the first quarter of fiscal 2008. The cumulative effects of applying FIN 48 will

be recorded as an adjustment to retained earnings as of the beginning of the period of adoption. Additionally, in May 2007,

the FASB published FASB Staff Position No. FIN 48-1, “Definition of Settlement in FASB Interpretation No. 48” (“FSP

FIN 48-1”). FSP FIN 48-1 is an amendment to FIN 48. It clarifies how an enterprise should determine whether a tax position

is effectively settled for the purpose of recognizing previously unrecognized tax benefits. FSP FIN 48-1 is effective upon the

initial adoption of FIN 48, and therefore will be adopted by HP in the first quarter of fiscal 2008. While HP is still evaluating

the impact of adoption of FIN 48 and FSP FIN 48-1 on its consolidated financial statements, it is estimated that the adoption

of FIN 48 and FSP FIN 48-1 will result in a net increase to retained earnings in the range of $500 million to $900 million.

This estimate is subject to revision as management completes its analysis.

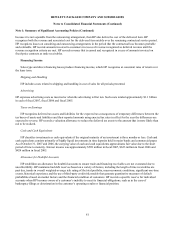

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (“SFAS 157”). SFAS 157 provides

guidance for using fair value to measure assets and liabilities. It also responds to investors’ requests for expanded information

about the extent to which companies measure assets and liabilities at fair value, the information used to measure fair value,

and the effect of fair value measurements on earnings. SFAS 157 applies whenever other standards require (or permit) assets

or liabilities to be measured at fair value, and does not expand the use of fair value in any new circumstances. SFAS 157 is

effective for financial statements issued for fiscal years beginning after November 15, 2007 and is required to be adopted by

HP in the first quarter of fiscal 2009. HP is currently evaluating the effect that the adoption of SFAS 157 will have on its

consolidated results of operations and financial condition and is not yet in a position to determine such effects.

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Plans—An Amendment of FASB No. 87, 88, 106 and 132(R)” (“SFAS 158”). SFAS 158 requires that the

funded status of defined benefit postretirement plans be recognized on the company’ s balance sheet and changes in the

funded status be reflected in

86