HP 2007 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

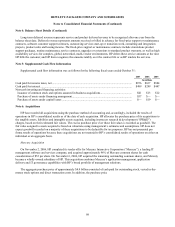

Note 6: Acquisitions (Continued)

recorded approximately $342 million of goodwill and $162 million of amortizable intangible assets. HP also expensed

$34 million for IPR&D. HP is amortizing the purchased intangibles, principally customer relationships and developed

technology, on a straight-line basis over their estimated useful lives ranging from five to six years.

Other Acquisitions in fiscal 2006

HP also completed seven other acquisitions during fiscal 2006. Total consideration for these acquisitions and the buyout

of a minority interest was approximately $473 million, which included direct transaction costs. The largest of these

transactions was the acquisition of substantially all of the assets of Scitex Vision Ltd (“Scitex”). The Scitex asset acquisition

expanded HP’ s leadership in printing into the industrial wide-format market.

HP recorded approximately $193 million of goodwill and $205 million of purchased intangibles in connection with these

other acquisitions. HP also recorded approximately $18 million of IPR&D related to these acquisitions in fiscal 2006.

In addition, HP paid approximately $17 million for the balance of the outstanding shares of Digital Globalsoft Limited, a

consolidated subsidiary of HP (“DGS”), and as a result increased HP’ s ownership from 98.5% to 100%. This subsidiary has

enhanced HP’ s capability in IT services, including expertise in life cycle services such as migration, technical and application

services.

HP has included the results of operations of these transactions prospectively from the respective date of the transaction.

HP has not presented the pro forma results of operations of the acquired businesses because the results are not material to

HP’ s results of operations on either an individual or an aggregate basis.

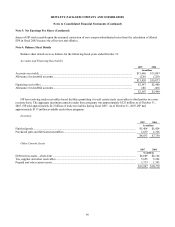

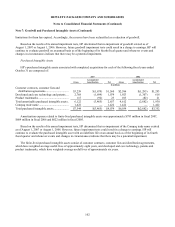

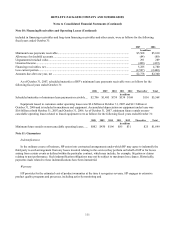

Note 7: Goodwill and Purchased Intangible Assets

Goodwill

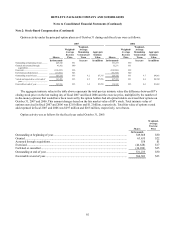

Goodwill allocated to HP’ s business segments as of October 31, 2007 and 2006 and changes in the carrying amount of

goodwill during the fiscal year ended October 31, 2007 are as follows:

HP

Services

Enterprise

Storage and

Servers

HP

Software

Personal

Systems

Group

Imaging

and

Printing

Group

HP

Financial

Services Total

In millions

Balance at October 31, 2006............... $6,339 $5,091 $1,098 $2,322 $1,853 $150 $16,853

Goodwill acquired during the period .. 93 173 4,868 290 71 — 5,495

Goodwill adjustments ......................... (211) (188) (45) (89) (37) (5) (575)

Balance at October 31, 2007............... $6,221 $5,076 $5,921 $2,523 $1,887 $145 $21,773

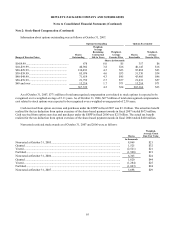

The goodwill adjustments relate primarily to the reversal of income tax reserves of Compaq Computer Corporation

(“Compaq”), which HP acquired in 2002, for pre-acquisition tax years. These tax years have been audited and agreed upon

with the Internal Revenue Service and the statute of

101