HP 2007 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

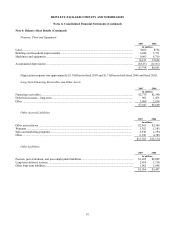

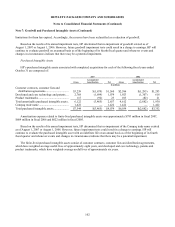

Note 7: Goodwill and Purchased Intangible Assets (Continued)

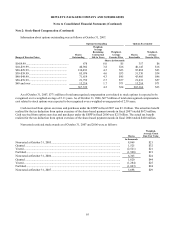

Estimated future amortization expense related to finite-lived purchased intangible assets at October 31, 2007 was as

follows:

Fiscal year: In millions

2008 ...................................................................................................................................................................... $ 779

2009 ...................................................................................................................................................................... 692

2010 ...................................................................................................................................................................... 585

2011 ...................................................................................................................................................................... 337

2012 ...................................................................................................................................................................... 166

Thereafter.............................................................................................................................................................. 98

Total...................................................................................................................................................................... $2,657

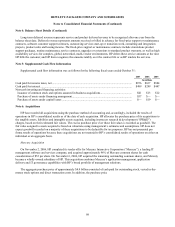

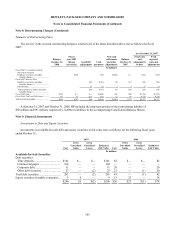

Note 8: Restructuring Charges

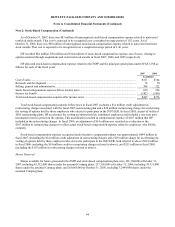

Fiscal 2007 U.S. Enhanced Early Retirement Program

In the second quarter of fiscal 2007, HP announced that it was offering eligible employees an option to participate in the

2007 EER. The 2007 EER was open to employees who satisfied defined eligibility criteria based on combined age and years

of service as well as to otherwise eligible employees who had been included in previous restructuring programs or who

voluntarily left the company since November 30, 2006. A total of 3,080 employees participated in the 2007 EER, including

595 persons who had been included in previous restructuring programs or who had voluntarily left the company since

November 30, 2006. All participating employees left the company by May 31, 2007. HP recorded a net restructuring charge

of $354 million in fiscal 2007 in connection with the 2007 EER. This charge reflected $367 million of severance and benefits

cost for the participating employees, $29 million of stock-based compensation expense for accelerating the vesting of options

held by participating employees and $2 million of outplacement costs. These charges were partially offset by a $28 million

settlement gain from HP’ s U.S. pension plan and a $16 million curtailment gain from its U.S. post-retirement benefit plans.

The net restructuring charge of $354 million for the 2007 EER program was subsequently offset by a $542 million

curtailment gain that HP recognized in fiscal 2007, resulting from changes in the U.S. defined benefit pension and post-

retirement plans that HP also announced in the second quarter of 2007. HP funded the cash expenditures associated with the

2007 EER primarily by using available U.S. pension plan assets. For more information, see Note 15, which is incorporated

herein by reference.

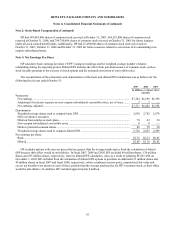

Fiscal 2007 Mercury Plan

In connection with the acquisition of Mercury, HP’ s management approved and initiated plans to restructure the

operations of Mercury to eliminate certain duplicative activities, reduce the cost structure and better align product and

operating expenses with existing general economic conditions. During fiscal 2007, HP recorded $45 million in

severance-related costs associated with the initial estimate of the elimination of approximately 370 positions primarily in the

United States and in Europe. HP eliminated substantially all of these positions and paid the majority of the related severance

payments in fiscal 2007.

103