HP 2007 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

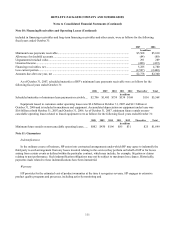

Note 12: Borrowings (Continued)

senior unsecured committed borrowing arrangement primarily to support the issuance of U.S. commercial paper. No amounts

are outstanding under the credit facility.

HP also maintains uncommitted lines of credit from a number of financial institutions that are available through various

foreign subsidiaries. The amount available for use as of October 31, 2007 was approximately $1.8 billion.

Included in Other, including capital lease obligations, are borrowings that are collateralized by certain financing

receivable assets. As of October 31, 2007, the carrying value of the assets approximated the carrying value of the borrowings

of $5 million.

At October 31, 2007, HP had up to approximately $10 billion of available borrowing resources under the 2002 Shelf

Registration Statement and other programs. HP also may issue additional debt securities, common stock, preferred stock,

depositary shares and warrants under the 2006 Shelf Registration Statement.

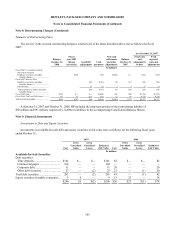

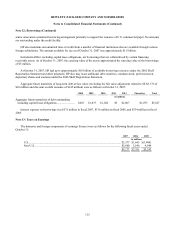

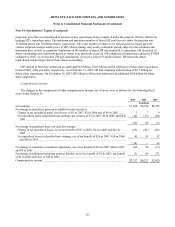

Aggregate future maturities of long-term debt at face value (excluding the fair value adjustment related to SFAS 133 of

$10 million and discount on debt issuance of $145 million) were as follows at October 31, 2007:

2008 2009 2010 2011 2012 Thereafter Total

In millions

Aggregate future maturities of debt outstanding

including capital lease obligations ......................... $683 $1,037 $1,022 $5 $2,007 $1,073 $5,827

Interest expense on borrowings was $531 million in fiscal 2007, $336 million in fiscal 2006, and $334 million in fiscal

2005.

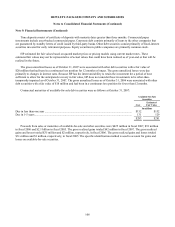

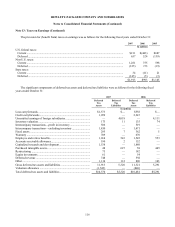

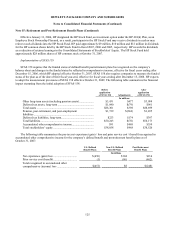

Note 13: Taxes on Earnings

The domestic and foreign components of earnings (losses) were as follows for the following fiscal years ended

October 31:

2007 2006 2005

In millions

U.S................................................................................................................................

.

$3,577 $1,645 $(1,406)

Non-U.S. ......................................................................................................................

.

$5,600 5,546 4,949

$9,177 $7,191 $3,543

115