HP 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

The year-over-year decrease in operating losses was driven primarily by higher earnings from operations generated by

network infrastructure products.

In fiscal 2006, the majority of the net revenue in Corporate Investments related to network infrastructure products, which

grew 8% from fiscal 2005 as a result of increased sales of gigabit Ethernet switch products.

Corporate Investments’ loss from operations in fiscal 2006 decreased compared to fiscal 2005 due primarily to lower

operating expenses related to global alliances and HP Labs and higher gross profits from network infrastructure products. The

decrease in operating expenses was due primarily to savings resulting from restructuring actions and lower program

spending. Expenses related to global alliances and HP Labs contributed to the majority of the loss from operations.

LIQUIDITY AND CAPITAL RESOURCES

Our cash balances are held in numerous locations throughout the world, including substantial amounts held outside of

the United States. Most of the amounts held outside of the United States could be repatriated to the United States but under

current law would be subject to United States federal income taxes, less applicable foreign tax credits. Repatriation of some

foreign balances is restricted by local laws. We have provided for the United States federal tax liability on these amounts for

financial statement purposes, except for foreign earnings that are considered indefinitely reinvested outside of the United

States. Repatriation could result in additional United States federal income tax payments in future years. Our intent is that

most of the non-U.S. cash balances would remain outside of the United States and we would meet United States liquidity

needs through ongoing cash flows, external borrowings, or both. We utilize a variety of tax planning and financing strategies

in an effort to ensure that our worldwide cash or debt is available in the locations in which it is needed.

FINANCIAL CONDITION (Sources and Uses of Cash)

Our total cash and cash equivalents declined approximately 31% to $11.3 billion at October 31, 2007 from $16.4 billion

at October 31, 2006 due primarily to increased spending for repurchases of our common stock and investment spending on

acquisitions, which spending was partially offset by positive operating cash flows and increased borrowings. The net

$14.7 billion used for investing and financing activities during fiscal 2007 included $10.9 billion for share repurchases,

$6.8 billion for cash payments in connection with acquisitions and $2.5 billion for net investments in property, plant and

equipment. Partially offsetting these cash expenditures were $3.1 billion of proceeds relating to the issuance of stock under

employee stock plans and a $2.6 billion net increase in our debt and commercial paper from increased borrowings. Our cash

position remains strong, and we believe our cash balances are sufficient to cover cash outlays expected in fiscal 2008

associated with additional stock repurchases, acquisitions, company bonus payments, and other operating cash requirements.

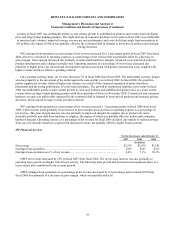

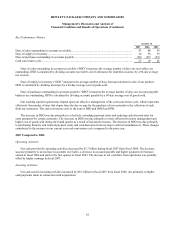

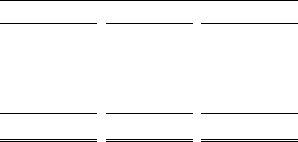

For the fiscal years ended October 31

2007 2006 2005

In millions

Net cash provided by operating activities......................................................................... $9,615 $11,353 $8,028

Net cash used in investing activities ................................................................................. (9,123) (2,787) (1,757)

Net cash used in financing activities................................................................................. (5,599) (6,077) (5,023)

Net (decrease) increase in cash and cash equivalents ....................................................... $(5,107) $2,489 $1,248

61