HP 2007 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

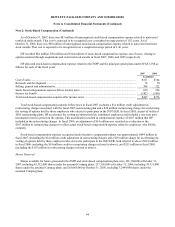

Note 8: Restructuring Charges (Continued)

During fiscal 2007, HP also recorded a total cost of $13 million related to exiting duplicative leased facilities. HP expects

to pay the costs for exiting the facilities through 2014.

All Mercury restructuring costs are reflected in the purchase price of Mercury in accordance with EITF 95-3,

“Recognition of Liabilities in Connection with a Purchase Business Combination.” These costs are subject to change based

on the actual costs incurred. Changes to these estimates could increase or decrease the amount of the purchase price allocated

to goodwill.

Fiscal 2005 Restructuring Plans

In the fourth quarter of fiscal 2005, HP’ s Board of Directors approved a restructuring plan designed to simplify HP’ s

structure, reduce costs and place greater focus on its customers. At that time, HP estimated that it would eliminate 15,300

positions in connection with the restructuring plan. Subsequent to the initial estimate, HP reduced the number of total

positions to 14,985. As of October 31, 2007, HP had substantially completed eliminating these positions. The initial charge

for these actions totaled $1.6 billion. During fiscal 2007, HP recognized a net $46 million reduction recorded in the first

quarter of fiscal 2007, which included severance adjustments for employees whose positions HP eliminated but who found

other positions within HP, a $14 million non-cash stock-based compensation expense adjustment, and a $9 million

curtailment gain relating to the HP subsidized U.S. retiree medical program. This net reduction was offset by $46 million of

higher employee severance and other benefit charges than originally estimated. HP had paid the majority of the costs related

to severance and other employee benefits as of October 31, 2007 and expects to pay out the remaining costs associated

primarily with tax payments for early retirees through fiscal 2018.

In the third quarter of fiscal 2005, HP’ s management approved a restructuring plan and HP recorded restructuring

charges of $109 million related to severance and related costs associated with the termination of approximately 1,450

employees, all of whom left HP as of October 31, 2005. HP paid all of the costs associated with the restructuring plan as of

January 31, 2007.

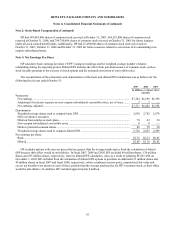

Fiscal 2003, 2002 and 2001 Restructuring Plans

The 2003, 2002 and 2001 restructuring plans are substantially complete, although HP records minor revisions to

previous estimates as necessary. In fiscal 2007, HP recorded an adjustment of $33 million in additional restructuring charges

relating primarily to facility lease obligations. As of October 31, 2007, the aggregate $69 million outstanding restructuring

liability with respect to these plans relates primarily to facility lease obligations. HP expects to pay the majority of these

obligations over the lives of the related obligations, which extend to the end of fiscal 2010.

Workforce Rebalancing

As part of our ongoing business operations, HP incurs workforce rebalancing charges for severance and related costs

within certain business segments. Workforce rebalancing activities are considered part of normal operations as HP continues

to optimize our cost structure. Workforce rebalancing costs are included in HP’ s business segment results, and HP expects to

incur additional workforce rebalancing costs in the future.

104