HP 2007 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

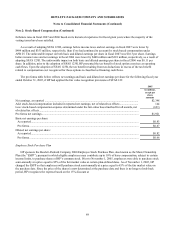

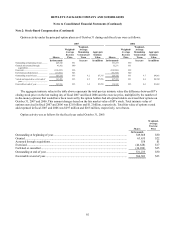

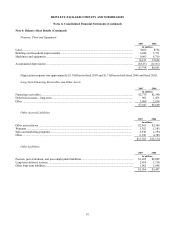

Note 2: Stock-Based Compensation (Continued)

HP had 549,045,000 shares of common stock reserved at October 31, 2007, 664,267,000 shares of common stock

reserved at October 31, 2006, and 794,750,000 shares of common stock reserved at October 31, 2005 for future issuance

under all stock-related benefit plans. Additionally, HP had 21,494,000 shares of common stock reserved at each of

October 31, 2007, October 31, 2006 and October 31, 2005 for future issuances related to conversion of its outstanding zero-

coupon subordinated notes.

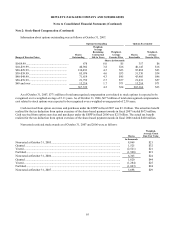

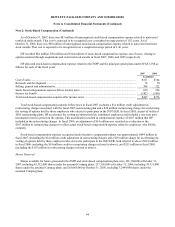

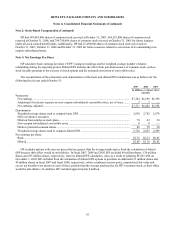

Note 3: Net Earnings Per Share

HP calculates basic earnings per share (“EPS”) using net earnings and the weighted-average number of shares

outstanding during the reporting period. Diluted EPS includes the effect from potential issuance of common stock, such as

stock issuable pursuant to the exercise of stock options and the assumed conversion of convertible notes.

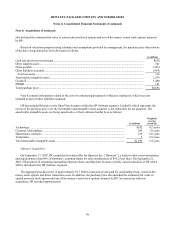

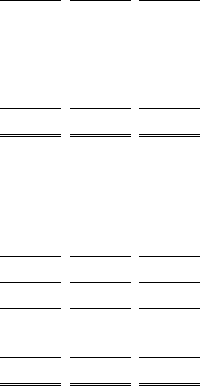

The reconciliation of the numerators and denominators of the basic and diluted EPS calculations was as follows for the

following fiscal years ended October 31:

2007 2006 2005

In millions, except per share

amounts

Numerator:

Net earnings ....................................................................................................................................... $7,264 $6,198 $2,398

Adjustment for interest expense on zero-coupon subordinated convertible notes, net of taxes......... 7 7 —

Net earnings, adjusted........................................................................................................................ $7,271 $6,205 $2,398

Denominator:

Weighted-average shares used to compute basic EPS ....................................................................... 2,630 2,782 2,879

Effect of dilutive securities:

Dilution from employee stock plans .................................................................................................. 78 62 30

Zero-coupon subordinated convertible notes..................................................................................... 8 8 —

Dilutive potential common shares...................................................................................................... 86 70 30

Weighted-average shares used to compute diluted EPS .................................................................... 2,716 2,852 2,909

Net earnings per share:

Basic .................................................................................................................................................. $2.76 $2.23 $0.83

Diluted ............................................................................................................................................... $2.68 $2.18 $0.82

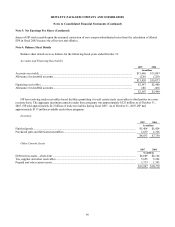

HP excludes options with exercise prices that are greater than the average market price from the calculation of diluted

EPS because their effect would be anti-dilutive. In fiscal 2007, 2006 and 2005, HP excluded 60 million shares, 130 million

shares and 255 million shares, respectively, from its diluted EPS calculation. Also, as a result of adopting SFAS 123R on

November 1, 2005, HP excluded from the calculation of diluted EPS options to purchase an additional 33 million shares and

48 million shares in fiscal 2007 and fiscal 2006, respectively, whose combined exercise price, unamortized fair value and

excess tax benefits were greater in each of those periods than the average market price for HP’ s common stock, as their effect

would be anti-dilutive. In addition, HP excluded approximately 8 million

95