HP 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

receivables during fiscal 2007. As of October 31, 2007, we had approximately $117 million available under these programs.

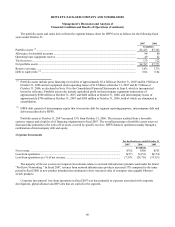

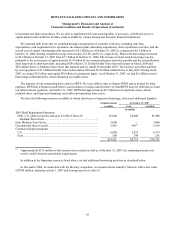

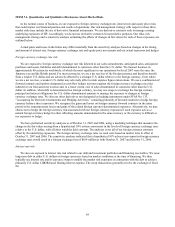

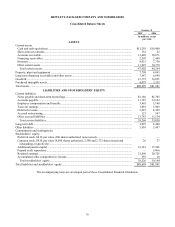

Contractual Obligations

The impact that we expect our contractual obligations as of October 31, 2007 to have on our liquidity and cash flow in

future periods is as follows:

Payments Due by Period

Total

Less than

1 Year 1-3 Years 3-5 Years

More than

5 Years

In millions

Long-term debt, including capital lease obligations ‘(1)........... $5,827 $683 $2,059 $2,012 $1,073

Operating lease obligations..................................................... 2,193 595 761 409 428

Purchase obligations(2) ............................................................ 2,029 1,826 164 24 15

Total........................................................................................ $10,049 $3,104 $2,984 $2,445 $1,516

‘(1) Amounts represent the expected cash payments of our long-term debt and do not include any fair value adjustments or

discounts. Included in our long-term debt are approximately $48 million of capital lease obligations that are secured by

certain equipment.

‘(2) Purchase obligations include agreements to purchase goods or services that are enforceable and legally binding on us and

that specify all significant terms, including fixed or minimum quantities to be purchased; fixed, minimum or variable

price provisions; and the approximate timing of the transaction. Purchase obligations exclude agreements that are

cancelable without penalty. These purchase obligations are related principally to inventory and other items.

Funding Commitments

During fiscal 2007, we made approximately $133 million of contributions to non-U.S. pension plans, paid $16 million to

cover benefit payments to U.S. non-qualified plan participants, and paid $58 million to cover benefit claims under post-

retirement benefit plans. In addition, we used $108 million of cash to fund the distribution and subsequent transfer of accrued

pension benefits from the U.S. Excess Benefit Plan to the U.S. Executive Deferred Compensation Plan for the terminated

vested plan participants. In fiscal 2008, we expect to contribute approximately $145 million to our pension plans and

approximately $15 million to cover benefit payments to U.S. non-qualified plan participants. We also expect to pay

approximately $80 million to cover benefit claims for our post-retirement benefit plans in fiscal 2008. Our funding policy is

to contribute cash to our pension plans so that we meet at least the minimum contribution requirements, as established by

local government and funding and taxing authorities. We expect to use contributions made to the post-retirement benefit

plans primarily for the payment of retiree health claims incurred during the fiscal year.

In conjunction with our February 2007 announcement to modify our U.S. defined benefit pension plan and our Pre-2003

Retiree Medical Program, we offered eligible affected employees an option to participate in the 2007 EER. We funded the

cash expenditures associated with the 2007 EER primarily by using available U.S. pension plan assets. We made no

incremental pension contributions to the pension plan stemming from the 2007 EER.

67