HP 2007 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

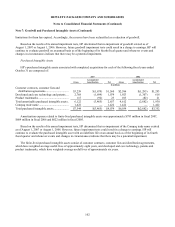

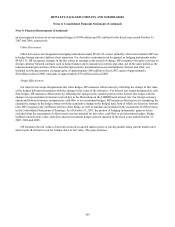

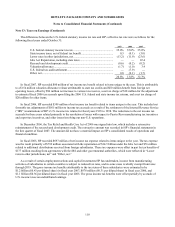

Note 9: Financial Instruments (Continued)

and fair market value of derivative financial instruments and the respective SFAS 133 classification on the Consolidated

Balance Sheets were as follows for the following fiscal years ended October 31:

2007

Gross

Notional

Other

Current

Assets

Long-term

Financing

Receivables

and

Other Assets

Other

Accrued

Liabilities

Other

Liabilities Total

In millions

Fair value hedges ............................................ $2,450 $— $21 $— $— $21

Cash flow hedges............................................ 9,657 73 — (183) — (110)

Net investment hedges .................................... 1,002 5 — (78) (27) (100)

Other derivatives............................................. 17,854 86 7(377) (87) (371)

Total................................................................ $30,963 $164 $28 $(638) $(114) $(560)

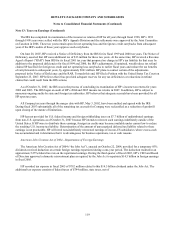

2006

Gross

Notional

Other

Current

Assets

Long-term

Financing

Receivables

and

Other Assets

Other

Accrued

Liabilities

Other

Liabilities Total

In millions

Fair value hedges ............................................ $2,550 $1 $2 $(1) $(3) $(1)

Cash flow hedges............................................ 8,768 33 — (97) — (64)

Net investment hedges .................................... 844 1 1 (8) (7) (13)

Other derivatives............................................. 10,482 25 13 (135) (28) (125)

Total................................................................ $22,644 $60 $16 $(241) $(38) $(203)

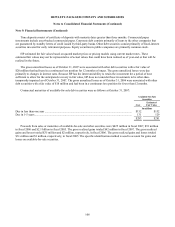

Fair Value of Other Financial Instruments

For certain of HP’ s financial instruments, including cash and cash equivalents, short-term investments, accounts

receivable, financing receivables, notes payable and short-term borrowings, accounts payable and other accrued liabilities,

the carrying amounts approximate fair value due to their short maturities. The estimated fair value of HP’ s short- and long-

term debt was approximately $8.1 billion at October 31, 2007, compared to a carrying value of $8.2 billion at that date. The

estimated fair value of the debt is based primarily on quoted market prices, as well as borrowing rates currently available to

HP for bank loans with similar terms and maturities.

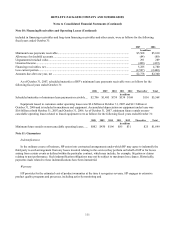

Note 10: Financing Receivables and Operating Leases

Financing receivables represent sales-type and direct-financing leases resulting from the marketing of HP’ s and

third-party products. These receivables typically have terms from two to five years and are usually collateralized by a security

interest in the underlying assets. Financing receivables also include billed receivables from operating leases. The components

of net financing receivables, which are

110