HP 2007 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

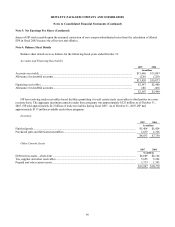

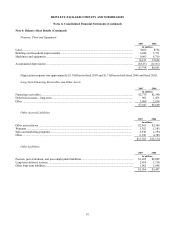

Notes to Consolidated Financial Statements (Continued)

Note 1: Summary of Significant Accounting Policies (Continued)

parties other than the parent, the amount of consolidated net income attributable to the parent and to the noncontrolling

interest, changes in a parent’ s ownership interest, and the valuation of retained noncontrolling equity investments when a

subsidiary is deconsolidated. SFAS 160 also establishes disclosure requirements that clearly identify and distinguish between

the interests of the parent and the interests of the noncontrolling owners. SFAS 160 is effective for fiscal years beginning

after December 15, 2008, and will be adopted by HP in the first quarter of fiscal 2010. HP is currently evaluating the

potential impact, if any, of the adoption of SFAS 160 on its consolidated results of operations and financial condition.

In addition to the SFAS 158 adoption mentioned above, HP adopted the following accounting standards in fiscal 2007,

none of which had a material effect on HP’ s consolidated results of operations during such period or financial condition at the

end of such period:

• SFAS No. 154, “Accounting for Changes and Error Corrections”;

• Staff Accounting Bulletin No. 108, “Considering the Effects of Prior Year Misstatements when Quantifying

Misstatements in Current Year Financial Statements”;

• EITF 05-5, “Accounting for Early Retirement or Postemployment Programs with Specific Features (Such as Terms

Specified in Altersteilzeit Early Retirement Arrangements)”; and

• EITF 06-9, “Reporting a Change in (or the Elimination of) a Previously Existing Difference between the Fiscal Year

End of a Parent Company and That of a Consolidated Entity or between the Reporting Period of an Investor and

That of an Equity Method Investee.”

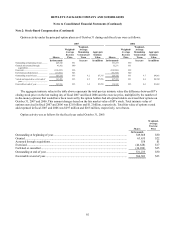

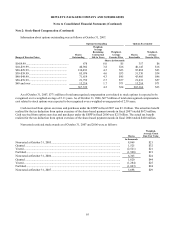

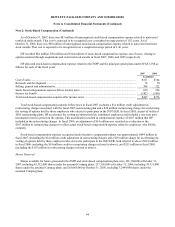

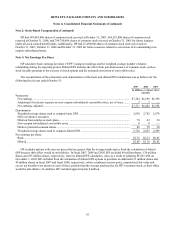

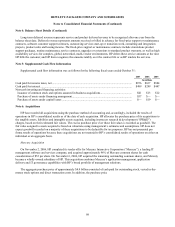

Note 2: Stock-Based Compensation

At October 31, 2007, HP has the stock-based employee compensation plans described below. The total compensation

expense before taxes related to these plans was $629 million and $536 million for fiscal 2007 and 2006, respectively.

Prior to November 1, 2005, HP accounted for those plans under the recognition and measurement provisions of APB 25.

Accordingly, HP generally recognized stock-based compensation expense only when it granted options with a discounted

exercise price. Any resulting compensation expense was recognized ratably over the associated service period, which was

generally the option vesting term. Prior to November 1, 2005, HP also provided pro forma disclosure amounts in accordance

with SFAS No. 148, “Accounting for Stock-Based Compensation—Transition and Disclosure” (“SFAS 148”), as if the fair

value method defined by SFAS 123 had been applied to its stock-based compensation.

Effective November 1, 2005, HP adopted the fair value recognition provisions of SFAS 123R, using the modified

prospective transition method and therefore has not restated prior periods’ results. Under this transition method, stock-based

compensation expense in fiscal 2006 included compensation expense for all share-based payment awards granted prior to, but

not yet vested as of, November 1, 2005, based on the grant-date fair value estimated in accordance with the original

provisions of SFAS 123. Stock-based compensation expense for all share-based payment awards granted after November 1,

2005 is based on the grant-date fair value estimated in accordance with the provisions of SFAS 123R. HP recognizes these

compensation costs net of an estimated forfeiture rate and recognizes the compensation costs for only those shares expected

to vest on a straight-line basis over the requisite service period of the award, which is generally the option vesting term of

four years. HP estimated the

88