HP 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

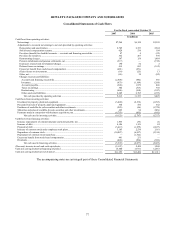

We have implemented bonus programs that are designed to reward our employees upon achievement of annual

performance objectives. We calculate bonuses based on a formula, with targets that are set at the beginning of each fiscal

year. Our Board of Directors approves both the formula and the targets.

In fiscal 2007, we outperformed against our targets, which will result in a significant bonus payout during the first

quarter of fiscal 2008 and a corresponding reduction of cash flow from operations in that quarter. We accrued and expensed

this bonus, as it was earned, throughout fiscal 2007.

As a result of our approved restructuring plans, we expect future cash expenditures of $173 million, which we recorded

on our Consolidated Balance Sheet at October 31, 2007. We expect to make cash payments of approximately $123 million in

fiscal 2008 and the majority of the remaining $50 million through 2014.

Pending and Subsequent Acquisitions

For pending acquisitions, see Note 6 to the Consolidated Financial Statements in Item 8, which is incorporated herein by

reference.

Off-Balance Sheet Arrangements

As part of our ongoing business, we do not participate in transactions that generate material relationships with

unconsolidated entities or financial partnerships, such as entities often referred to as structured finance or special purpose

entities (“SPEs”), which would have been established for the purpose of facilitating off-balance sheet arrangements or other

contractually narrow or limited purposes. As of October 31, 2007, we are not involved in any material unconsolidated SPEs.

Indemnifications

In the ordinary course of business, we enter into contractual arrangements under which we may agree to indemnify the

third-party to such arrangement from any losses incurred relating to the services they perform on behalf of us or for losses

arising from certain events as defined within the particular contract, which may include, for example, litigation or claims

relating to past performance. Such indemnification obligations may not be subject to maximum loss clauses. Historically,

payments we have made related to these indemnifications have been immaterial.

68