HP 2007 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

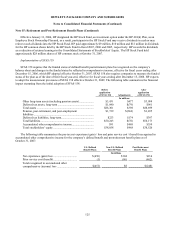

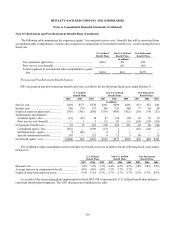

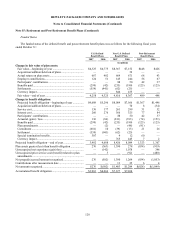

Note 15: Retirement and Post-Retirement Benefit Plans (Continued)

Effective January 31, 2004, HP designated the HP Stock Fund, an investment option under the HP 401(k) Plan, as an

Employee Stock Ownership Plan and, as a result, participants in the HP Stock Fund may receive dividends in cash or may

reinvest such dividends into the HP Stock Fund. HP paid approximately $9 million, $10 million and $12 million in dividends

for the HP common shares held by the HP Stock Fund in fiscal 2007, 2006 and 2005, respectively. HP records the dividends

as a reduction of retained earnings in the Consolidated Statements of Stockholders’ Equity. The HP Stock Fund held

approximately $28 million shares of HP common stock at October 31, 2007.

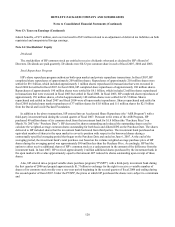

Implementation of SFAS 158

SFAS 158 requires that the funded status of defined benefit postretirement plans be recognized on the company’ s

balance sheet and changes in the funded status be reflected in comprehensive income, effective for fiscal years ending after

December 15, 2006, which HP adopted effective October 31, 2007. SFAS 158 also requires companies to measure the funded

status of the plan as of the date of their fiscal year-end, effective for fiscal years ending after December 15, 2008. HP expects

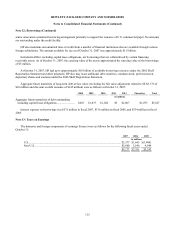

to adopt the measurement provisions of SFAS 158 effective October 31, 2009. The following table summarizes the financial

impact stemming from the initial adoption of SFAS 158:

Before

application

of SFAS 158 Adjustments

After

application

of SFAS 158

In millions

Other long-term assets (including pension assets).................... $3,431 $477 $3,908

Deferred tax assets, long-term .................................................. $1,040 $(79) $961

Total assets ............................................................................... $88,301 $398 $88,699

Pension, post-retirement, and post-employment

liabilities ...................................................................................

$1,739 $(244) $1,495

Deferred tax liabilities, long-term............................................. $223 $174 $397

Total liabilities.......................................................................... $50,243 $(70) $50,173

Accumulated other comprehensive income.............................. $91 $468 $559

Total stockholders’ equity ........................................................ $38,058 $468 $38,526

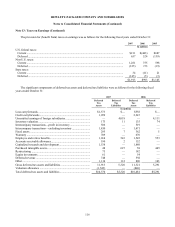

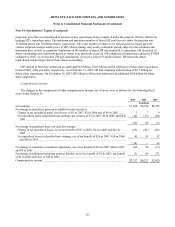

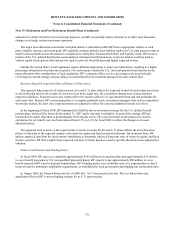

The following table summarizes the pre-tax net experience (gain) / loss and prior service cost / (benefit) recognized in

accumulated other comprehensive income for the company’ s defined benefit and postretirement benefit plans as of

October 31, 2007.

U.S. Defined

Benefit Plans

Non-U.S. Defined

Benefit Plans

Post-Retirement

Benefit Plans

In millions

Net experience (gain) loss ................................. $(450) $104 $214

Prior service cost (benefit)................................. (1) (96) (462)

Total recognized in accumulated other

comprehensive (income) loss ............................ $(451) $8 $(248)

125