HP 2007 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 15: Retirement and Post-Retirement Benefit Plans (Continued)

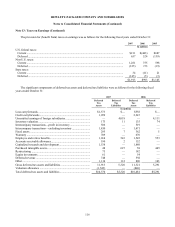

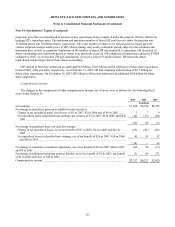

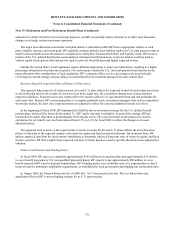

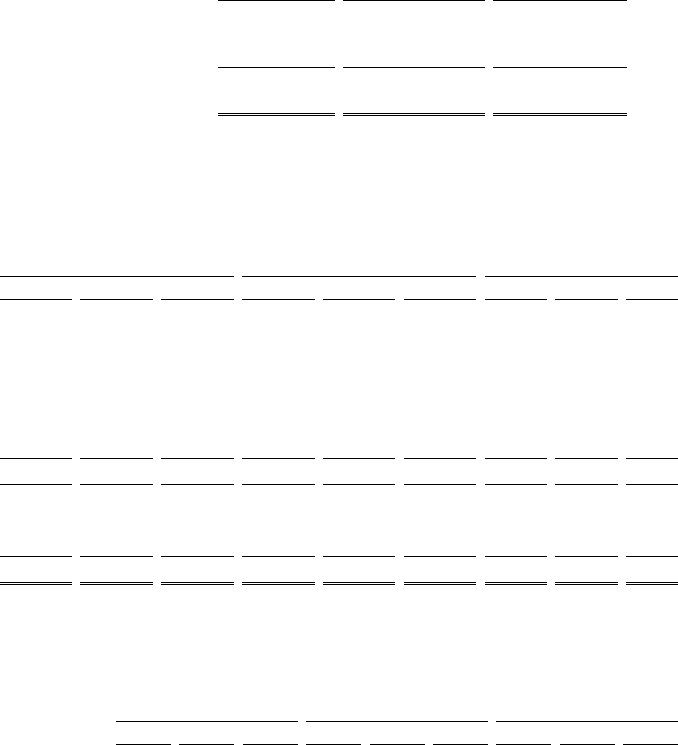

The following table summarizes the experience (gain) / loss and prior service cost / (benefit) that will be amortized from

accumulated other comprehensive income and recognized as components of net periodic benefit cost / (credit) during the next

fiscal year.

U.S. Defined

Benefit Plans

Non-U.S. Defined

Benefit Plans

Post-Retirement

Benefit Plans

In millions

Net experience (gain) loss ...................................................... $(36) $2 $19

Prior service cost (benefit)...................................................... — (8) (56)

Total recognized in accumulated other comprehensive (gain)

loss...................................................................................... $(36) $(6) $(37)

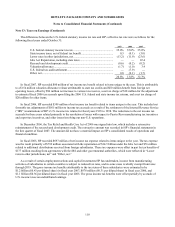

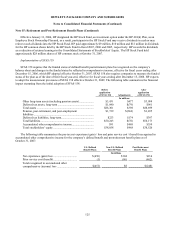

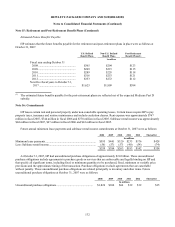

Pension and Post-Retirement Benefit Expense

HP’ s net pension and post-retirement benefit costs were as follows for the following fiscal years ended October 31:

U.S. Defined

Benefit Plans

Non-U.S. Defined

Benefit Plans

Post-Retirement

Benefit Plans

2007 2006 2005 2007 2006 2005 2007 2006 2005

In millions

Service cost............................................ $130 $177 $338 $261 $299 $236 $31 $32 $63

Interest cost............................................ 260 276 275 366 325 304 77 84 98

Expected return on plan assets............... (355) (361) (290) (579) (495) (412) (38) (34) (32)

Amortization and deferrals:

Actuarial (gain) / loss.......................... (13) (14) 38 87 136 104 26 39 35

Prior service cost (benefit).................. — 1 2 (7) (3) (1) (54) (55) (18)

Net periodic benefit cost........................ 22 79 363 128 262 231 42 66 146

Curtailment (gain) / loss...................... (541) — (199) (13) 1 — (26) (24) —

Settlement loss / (gain)........................ 8 (46) — 4 2 1 — — —

Special termination benefits................ 307 —352 412 3 60 —55

Net benefit (gain) / cost ......................... $(204) $33 $516 $123 $277 $235 $76 $42 $201

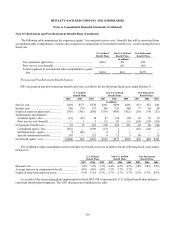

The weighted average assumptions used to calculate net benefit cost were as follows for the following fiscal years ended

October 31:

U.S. Defined

Benefit Plans

Non-U.S. Defined

Benefit Plans

Post-Retirement

Benefit Plans

2007 2006 2005 2007 2006 2005 2007 2006 2005

Discount rate................................................................. 5.9% 5.9% 5.7% 4.4% 4.2% 4.9% 5.8% 5.8% 5.6%

Average increase in compensation levels ..................... 4.0% 4.0% 4.0% 3.3% 3.7% 3.7% — — —

Expected long-term return on assets ............................. 8.3% 8.3% 8.3% 6.7% 6.7% 6.7% 8.3% 8.3% 8.3%

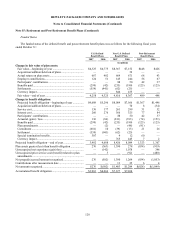

As a result of the restructuring plans implemented in fiscal 2007, HP re-measured its U.S. defined benefit plan and post-

retirement benefit plan obligations. The 2007 discount rates outlined in the table

126