HP 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

• We are expanding our ethics and compliance programs and enhancing our corporate governance to ensure that all of

our actions are consistent with HP’ s values; and

• We are repurchasing shares of our common stock under an ongoing program to manage the dilution created by

shares issued under employee stock plans as well as to repurchase shares opportunistically.

We continue to grow our business organically and through strategic acquisitions. During fiscal 2007, we acquired ten

companies, among which the two largest were Mercury Interactive Corporation (“Mercury”) and Opsware Inc., and we

expect to continue to make strategic acquisitions periodically in the future.

In February 2007, we announced our decision to modify our U.S. defined benefit pension plan for the remaining number

of U.S. employees still accruing benefits under the program. Effective January 1, 2008, these employees will cease accruing

pension benefits and will, instead, receive an increased 401(k) match to 6 percent from 4 percent of eligible earnings. The

final pension benefit amount will be calculated based on pay and service through December 31, 2007. In addition, future

eligibility for the Pre-2003 HP Retiree Medical Program was limited to those employees who were within five years of

satisfying the program’ s eligibility criteria on June 30, 2007. These actions reduced our U.S. defined benefit and post-

retirement plan obligations, and, as a result, we recorded a one-time curtailment gain of $542 million in fiscal 2007. In

conjunction with this announcement, we provided eligible affected employees with the opportunity to participate in a 2007

U.S. Enhanced Early Retirement program (the “2007 EER”) and recorded a restructuring charge of $354 million during fiscal

2007. A total of 3,080 employees participated in the 2007 EER, including 595 persons who had been included in previous

restructuring programs or who voluntarily left the company since November 30, 2006. All employees who participated in the

2007 EER left the company by May 31, 2007. For more information, see Notes 8 and 15 to the Consolidated Financial

Statements in Item 8, which are incorporated herein by reference.

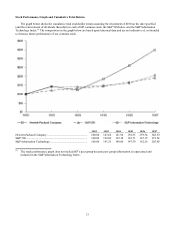

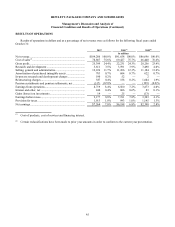

In terms of how our execution has translated into financial performance, the following provides an overview of our key

fiscal 2007 financial metrics:

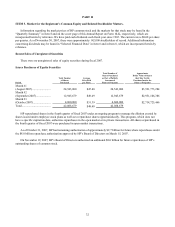

TSG

HP

Consolidated ESS HPS

HP

Software Total PSG IPG HPFS

In millions, except per share amounts

Net revenue.......................................... $104,286 $18,769 $16,646 $2,325 $37,740 $36,409 $28,465 $2,336

Year-over-year net revenue %

increase ............................................ 13.8% 8.4% 6.6% 78.7% 10.3% 24.8% 6.3% 12.4%

Earnings from operations..................... $8,719 $1,980 $1,829 $347 $4,156 $1,939 $4,315 $155

Earnings from operations as a % of

net revenue........................................... 8.4% 10.5% 11.0% 14.9% 11.0% 5.3% 15.2% 6.6%

Net earnings......................................... $7,264

Net earnings per share

Basic .................................................... $2.76

Diluted ................................................. $2.68

Cash and cash equivalents at October 31, 2007 totaled $11.3 billion, a decrease of $5.1 billion from the October 31, 2006

balance of $16.4 billion. The decrease for fiscal 2007 was related primarily to $10.9 billion paid to repurchase our common

stock, $6.8 billion of net cash paid for business acquisitions and $2.5 billion net investments in property, plant and

equipment, all of which were

36