HP 2007 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

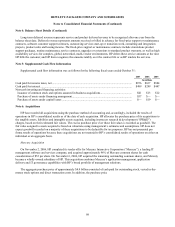

Note 6: Acquisitions (Continued)

also included the estimated fair value of earned unvested stock options and out-of-the-money vested stock options assumed

by HP.

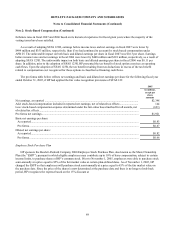

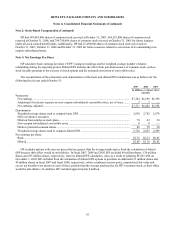

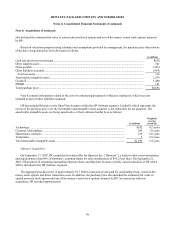

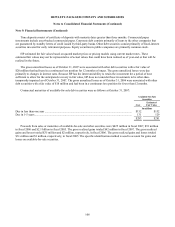

Based on valuations prepared using estimates and assumptions provided by management, the purchase price allocation as

of the date of acquisition has been allocated as follows:

In millions

Cash and short-term investments............................................................................................................................. $830

Other tangible assets ................................................................................................................................................ 541

Notes payable .......................................................................................................................................................... (303)

Other liabilities assumed.......................................................................................................................................... (954)

Total net assets...................................................................................................................................................... 114

Amortizable intangible assets .................................................................................................................................. 1,079

Goodwill .................................................................................................................................................................. 3,480

IPR&D..................................................................................................................................................................... 181

Total purchase price................................................................................................................................................. $4,854

Note 8 contains information related to the cost of restructuring programs for Mercury employees, which was also

included as part of other liabilities assumed.

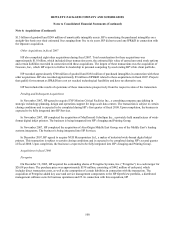

HP has included Mercury in the OpenView business within the HP Software segment. Goodwill, which represents the

excess of the purchase price over the net tangible and intangible assets acquired, is not deductible for tax purposes. The

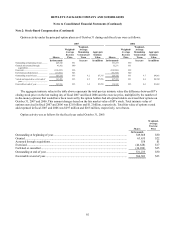

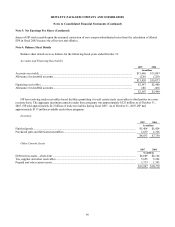

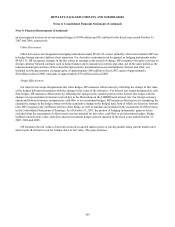

amortizable intangible assets are being amortized over their estimated useful lives as follows:

In millions

Weighted-

average

useful life

Technology .................................................................................................................................... $592 4.2 years

Customer relationships .................................................................................................................. 243 7.0 years

Maintenance contracts ................................................................................................................... 239 6.8 years

Trademarks .................................................................................................................................... 5 6.0 years

Total amortizable intangible assets................................................................................................ $1,079 5.4 years

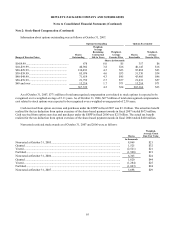

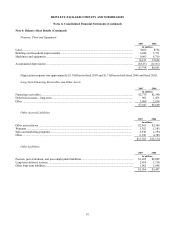

Opsware Acquisition

On September 17, 2007, HP completed its tender offer for Opsware Inc. (“Opsware”), a leader in data center automation,

and acquired more than 90% of Opsware’ s common shares for cash consideration of $14.25 per share. On September 21,

2007, HP acquired all remaining outstanding Opsware shares and Opsware became a wholly owned subsidiary of HP which

will be included in the HP Software segment.

The aggregate purchase price of approximately $1.7 billion consisted of cash paid for outstanding stock, vested in-the-

money stock options and direct transaction costs. In addition, the purchase price also included the estimated fair value of

earned unvested stock options and out-of-the-money vested stock options assumed by HP. In connection with this

acquisition, HP recorded approximately

99