HP 2007 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

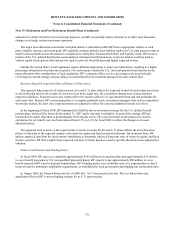

Note 14: Stockholders’ Equity (Continued)

maximum price that was determined in advance of any repurchases being completed under the program, thereby effectively

hedging HP’ s repurchase price. The minimum and maximum number of shares HP could receive under the program was

52 million shares and 70 million shares, respectively. The exact number of shares to be repurchased was based upon the

volume weighted-average market price of HP’ s shares during each weekly settlement period, subject to the minimum and

maximum price as well as regulatory limitations on the number of shares HP was permitted to repurchase. HP decreased its

shares outstanding each settlement period as shares were physically received. HP completed all repurchases under the PVSPP

on March 9, 2007. As of that date, HP had cumulatively received a total of 53 million shares. HP retired all shares

repurchased and no longer deems those shares outstanding.

HP’ s Board of Directors authorized an additional $8.0 billion, $10.0 billion and $4.0 billion for future share repurchases

in fiscal 2007, 2006 and 2005, respectively. As of October 31, 2007, HP had remaining authorization of $2.7 billion for

future share repurchases. On November 19, 2007, HP’ s Board of Directors authorized an additional $8.0 billion for future

share repurchases.

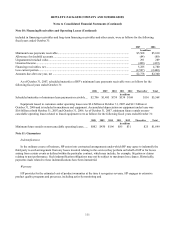

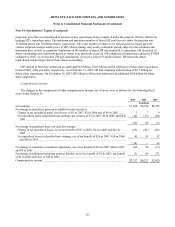

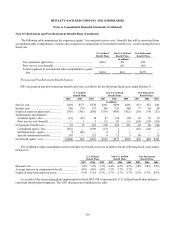

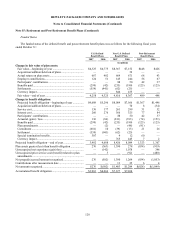

Comprehensive Income

The changes in the components of other comprehensive income, net of taxes, were as follows for the following fiscal

years ended October 31:

2007 2006 2005

In millions

Net earnings..................................................................................................................................... $7,264 $6,198 $2,398

Net change in unrealized gains on available-for-sale securities:

Change in net unrealized gains, net of taxes of $2 in 2007, $3 in 2006 and of $6 in 2005........... 2 7 9

Net unrealized gains reclassified into earnings, net of taxes of $7 in 2007, $9 in 2006 and $6 in

2005 ...........................................................................................................................................

(14) (13) (10)

(12) (6) (1)

Net change in unrealized losses on cash flow hedges:

Change in net unrealized losses, net of tax benefit of $37 in 2007, $24 in 2006 and $16 in

2005 ...........................................................................................................................................

(63) (41) (28)

Net unrealized losses reclassified into earnings, net of tax benefit of $26 in 2007, $24 in 2006

and $56 in 2005..........................................................................................................................

45 41 97

(18) —69

Net change in cumulative translation adjustment, net of tax benefit of $37 in 2007, $40 in 2006

and $8 in 2005 .................................................................................................................................

106 54 (17)

Net change in additional minimum pension liability, net of tax benefit of $1 in 2007, tax benefit

of $1 in 2006 and taxes of $89 in 2005............................................................................................

(3) (9) 171

Comprehensive income.................................................................................................................... $7,337 $6,237 $2,620

121