HP 2007 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

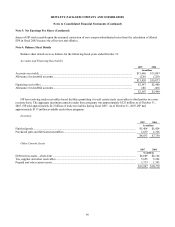

Note 3: Net Earnings Per Share (Continued)

shares of HP stock issuable upon the assumed conversion of zero-coupon subordinated notes from the calculation of diluted

EPS in fiscal 2005 because the effect was anti-dilutive.

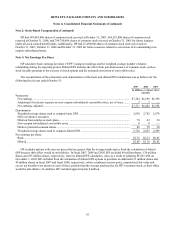

Note 4: Balance Sheet Details

Balance sheet details were as follows for the following fiscal years ended October 31:

Accounts and Financing Receivables

2007 2006

In millions

Accounts receivable................................................................................................................................. $13,646 $11,093

Allowance for doubtful accounts............................................................................................................. (226) (220)

$13,420 $10,873

Financing receivables .............................................................................................................................. $2,547 $2,480

Allowance for doubtful accounts............................................................................................................. (40) (40)

$2,507 $2,440

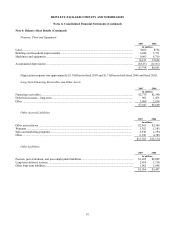

HP has revolving trade receivables-based facilities permitting it to sell certain trade receivables to third parties on a non-

recourse basis. The aggregate maximum capacity under these programs was approximately $525 million as of October 31,

2007. HP sold approximately $2.2 billion of trade receivables during fiscal 2007. As of October 31, 2007, HP had

approximately $117 million available under these programs.

Inventory

2007 2006

In millions

Finished goods.............................................................................................................................................. $5,404 $5,424

Purchased parts and fabricated assemblies ................................................................................................... 2,629 2,326

$8,033 $7,750

Other Current Assets

2007 2006

In millions

Deferred tax assets—short-term ................................................................................................................... $4,609 $4,144

Tax, supplier and other receivables .............................................................................................................. 5,655 5,242

Prepaid and other current assets.................................................................................................................... 1,733 1,393

$11,997 $10,779

96