HP 2007 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

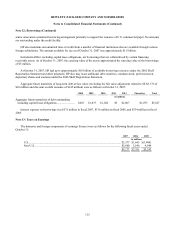

Note 13: Taxes on Earnings (Continued)

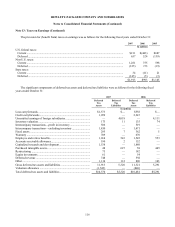

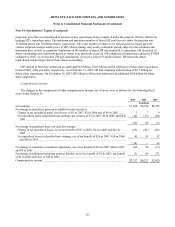

The provision for (benefit from) taxes on earnings was as follows for the following fiscal years ended October 31:

2007 2006 2005

In millions

U.S. federal taxes:

Current ...................................................................................................................................... $211 $(443) $687

Deferred .................................................................................................................................... 657 524 (139)

Non-U.S. taxes:

Current ...................................................................................................................................... 1,281 755 598

Deferred .................................................................................................................................... (125) 173 (19)

State taxes:

Current ...................................................................................................................................... 34 (11) 21

Deferred .................................................................................................................................... (145) (5) (3)

$1,913 $993 $1,145

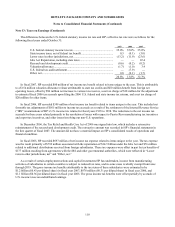

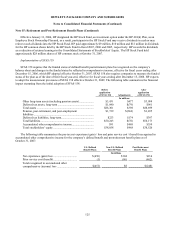

The significant components of deferred tax assets and deferred tax liabilities were as follows for the following fiscal

years ended October 31:

2007 2006

Deferred

Tax

Assets

Deferred

Tax

Liabilities

Deferred

Tax

Assets

Deferred

Tax

Liabilities

In millions

Loss carryforwards ........................................................................ $1,573 $— $558 $—

Credit carryforwards...................................................................... 1,999 — 2,247 —

Unremitted earnings of foreign subsidiaries .................................. — 4,018 — 4,111

Inventory valuation........................................................................ 173 11 135 74

Intercompany transactions—profit in inventory............................ 506 — 519 —

Intercompany transactions—excluding inventory ......................... 1,850 — 1,471 —

Fixed assets.................................................................................... 295 7 362 5

Warranty ........................................................................................ 709 — 670 —

Employee and retiree benefits........................................................ 1,014 543 1,545 553

Accounts receivable allowance...................................................... 190 2 152 —

Capitalized research and development........................................... 1,538 — 1,880 —

Purchased intangible assets............................................................ 48 627 58 445

Restructuring ................................................................................. 75 — 182 —

Equity investments......................................................................... 61 — 54 —

Deferred revenue ........................................................................... 748 — 592 —

Other .............................................................................................. 1,134 112 896 103

Gross deferred tax assets and liabilities ......................................... 11,913 5,320 11,321 5,291

Valuation allowance ...................................................................... (1,543) — (840) —

Total deferred tax assets and liabilities.......................................... $10,370 $5,320 $10,481 $5,291

116