HP 2007 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

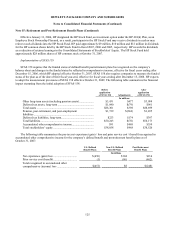

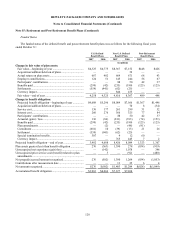

Note 15: Retirement and Post-Retirement Benefit Plans (Continued)

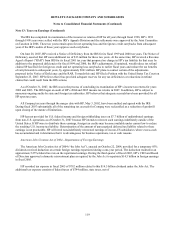

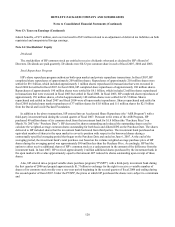

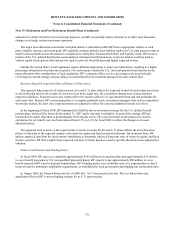

made to pension plan participants who left HP under the 2007 EER. These lump sum benefit payments, which were paid out

to participants during the October 1, 2006 to September 30, 2007 measurement period, represent a reduction in the projected

benefit obligation. As a result, a portion of the unrecognized gain was recognized in fiscal 2007. The gain was recorded in

accordance with SFAS No. 88, “Employers’ Accounting for Settlements and Curtailments of Defined Benefit Pension Plans

and for Termination Benefits,” which requires that a settlement event be recorded once prescribed payment thresholds have

been reached. HP recorded this $28 million as a reduction to the restructuring charge recorded in connection with the

2007 EER.

In fiscal 2007, HP recognized a net curtailment gain of $26 million for its U.S. post-retirement benefit plans. The gain

included $16 million and $9 million, resulting from the reduction in the eligible plan population stemming from the

2007 EER and the restructuring plans implemented in fiscal 2005, respectively. HP reported these gains as reductions to the

restructuring charge. HP also recorded a one-time curtailment gain of $1 million for its post-retirement benefit plans as a

result of the modification of its Pre-2003 HP Retiree Medical Program in fiscal 2007 as described above in detail.

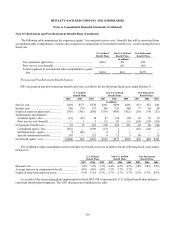

In fiscal 2007 HP recognized net curtailment gains of $13 million in connection with its non-U.S. defined benefit plans.

These gains reflected a plan design change in Mexico and Canada of $11 million where HP ceased pension accruals for

current employees who did not meet defined criteria based on age and years of service and a $2 million gain related to the

fiscal 2005 restructuring programs recorded as a reduction to the restructuring charges in fiscal 2007. Also in fiscal 2007, HP

recognized a restructuring settlement expense of $4 million. The settlement expense reflected primarily the distribution of

lump-sum benefit payments in Mexico and Canada, thereby resulting in a portion of the unrecognized loss being recorded as

expense once the settlement recognition thresholds had been reached. In addition, HP incurred a $4 million restructuring

special termination benefit expense associated with the early retirement of employees in the U.K. and Ireland.

Defined Benefit Plans

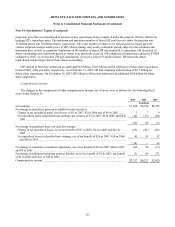

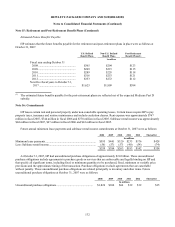

HP sponsors a number of defined benefit pension plans worldwide, of which the most significant are in the United

States. The HP Retirement Plan (the “Retirement Plan”) is a defined benefit pension plan for U.S. employees hired on or

before December 31, 2002. Benefits under the Retirement Plan generally are based on pay and years of service, except for

eligible pre-acquisition Compaq employees, who do not receive credit for years of service prior to January 1, 2003. Effective

December 31, 2005, participants whose combination of age plus years of service is less than 62 ceased accruing benefits

under the Retirement Plan. Effective January 1, 2008, the remaining number of U.S. employees still accruing benefits under

the program will cease accruing pension benefits.

For U.S employees hired or rehired on or after January 1, 2003, HP sponsors the Hewlett-Packard Company Cash

Account Pension Plan (the “Cash Account Pension Plan”), under which benefits accrue pursuant to a cash accumulation

account formula based upon a percentage of pay plus interest. Effective November 30, 2005, HP merged the Cash Account

Pension Plan into the Retirement Plan; the merged plan is treated as one plan for certain legal and financial purposes,

including funding requirements. The merger has no impact on the separate benefit structures of the plans. Effective

December 31, 2005, the Cash Account Pension Plan was closed to new participants, and participants whose combination of

age plus years of service is less than 62 will cease accruing benefits.

123