HP 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

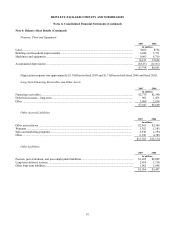

Notes to Consolidated Financial Statements (Continued)

Note 1: Summary of Significant Accounting Policies (Continued)

comprehensive income, effective for fiscal years ending after December 15, 2006, which HP adopted during fiscal 2007. See

Note 15 for the effect of applying this provision on the consolidated financial statements. SFAS 158 also requires companies

to measure the funded status of the plan as of the date of their fiscal year end, effective for fiscal years ending after

December 15, 2008. HP expects to adopt the measurement provisions of SFAS 158 effective October 31, 2009.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial

Liabilities—Including an amendment of FASB Statement No. 115” (“SFAS 159”). SFAS 159 expands the use of fair value

accounting but does not affect existing standards that require assets or liabilities to be carried at fair value. Under SFAS 159,

a company may elect to use fair value to measure accounts and loans receivable, available-for-sale and held-to-maturity

securities, equity method investments, accounts payable, guarantees and issued debt. Other eligible items include firm

commitments for financial instruments that otherwise would not be recognized at inception and non-cash warranty

obligations where a warrantor is permitted to pay a third party to provide the warranty goods or services. If the use of fair

value is elected, any upfront costs and fees related to the item must be recognized in earnings and cannot be deferred, such as

debt issuance costs. The fair value election is irrevocable and generally made on an instrument-by-instrument basis, even if a

company has similar instruments that it elects not to measure based on fair value. At the adoption date, unrealized gains and

losses on existing items for which fair value has been elected are reported as a cumulative adjustment to beginning retained

earnings. Subsequent to the adoption of SFAS 159, changes in fair value are recognized in earnings. SFAS 159 is effective

for fiscal years beginning after November 15, 2007 and is required to be adopted by HP in the first quarter of fiscal 2009. HP

currently is determining whether fair value accounting is appropriate for any of its eligible items and cannot estimate the

impact, if any, that SFAS 159 will have on its consolidated results of operations and financial condition.

In June 2007, the FASB also ratified EITF 07-3, “Accounting for Nonrefundable Advance Payments for Goods or

Services Received for Use in Future Research and Development Activities” (“EITF 07-3”). EITF 07-3 requires that

nonrefundable advance payments for goods or services that will be used or rendered for future research and development

activities be deferred and capitalized and recognized as an expense as the goods are delivered or the related services are

performed. EITF 07-3 is effective, on a prospective basis, for fiscal years beginning after December 15, 2007 and will be

adopted by HP in the first quarter of fiscal 2009. HP does not expect the adoption of EITF 07-3 to have a material effect on

HP’ s consolidated results of operations and financial condition.

In December 2007, the FASB issued SFAS No. 141 (revised 2007), “Business Combinations” (“SFAS 141R”).

SFAS 141R establishes principles and requirements for how an acquirer recognizes and measures in its financial statements

the identifiable assets acquired, the liabilities assumed, any noncontrolling interest in the acquiree and the goodwill acquired.

SFAS 141R also establishes disclosure requirements to enable the evaluation of the nature and financial effects of the

business combination. SFAS 141R is effective for fiscal years beginning after December 15, 2008, and will be adopted by HP

in the first quarter of fiscal 2010. HP is currently evaluating the potential impact, if any, of the adoption of SFAS 141R on its

consolidated results of operations and financial condition.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements—an

amendment of Accounting Research Bulletin No. 51” (“SFAS 160”). SFAS 160 establishes accounting and reporting

standards for ownership interests in subsidiaries held by

87