HP 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

Subsequent to the initial estimate, we reduced the number of total positions to be eliminated to 14,985. We had substantially

completed eliminating these positions as of October 31, 2007. The remaining charge for fiscal 2005 of $109 million was

related to severance and related costs associated with the termination of approximately 1,450 employees in connection with a

restructuring plan approved by our management in the third quarter of fiscal 2005. All employees under this restructuring

plan were terminated as of October 31, 2005. We paid all of the costs associated with the fiscal 2005 third quarter

restructuring plan as of January 31, 2007.

For more information on our restructuring charges, see Note 8 to the Consolidated Financial Statements in Item 8, which

is incorporated herein by reference.

Workforce Rebalancing

As part of our ongoing business operations, we incur workforce rebalancing charges for severance and related costs

within certain business segments. Workforce rebalancing activities are considered part of normal operations as we continue to

optimize our cost structure and are included in our business segment results. We expect to incur additional workforce

rebalancing costs in the future.

Pension Curtailments and Pension Settlements, Net

In fiscal 2007, we recognized a net gain on pension curtailments and settlements of $517 million, relating primarily to a

$542 million curtailment gain associated with a modification to our U.S. defined benefit pension plan and post-retirement

benefit plan. This curtailment gain was offset partially by net settlement losses related to our other pension plan design

changes.

In conjunction with management’ s plan to restructure certain of our operations, we modified our U.S. retirement

programs to align them more closely to industry practice. Effective January 1, 2006, we ceased pension accruals and

eliminated eligibility for the subsidized retiree medical program for employees who did not meet defined criteria based on

age and years of service. As a result, we recognized a curtailment gain of $199 million in fiscal 2005 stemming from the

elimination of future benefit accruals for the affected employee group.

For more information on our plan design changes, see Note 15 to the Consolidated Financial Statements in Item 8, which

is incorporated herein by reference.

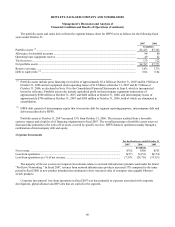

Interest and Other, Net

Interest and other, net decreased by $162 million in fiscal 2007 from fiscal 2006. The decrease was due primarily to

higher interest expense resulting from higher average debt balances.

Interest and other, net increased by $523 million in fiscal 2006 from fiscal 2005. The increase in fiscal 2006 resulted

primarily from higher net interest income over the prior year related to higher short-term interest rates in fiscal 2006, net

gains from sales of certain real estate properties, and lower interest expense due to our lower average debt balances. The

increase in fiscal 2006 also was attributable to a net $106 million of dispute settlement charge and its related interest charge

recorded in fiscal 2005. In fiscal 2005, we reached a legal settlement of $141 million in our patent infringement case with

Intergraph Hardware Technologies Company (“Intergraph”) and recorded a charge of $116 million related to a cross-license

agreement with Intergraph for products shipped in prior years. Partially offsetting this amount was a $10 million recovery

from an individual related to a prior period settlement with the Government of Canada.

50