HP 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

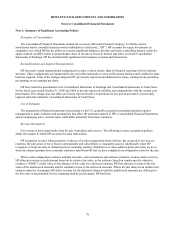

Notes to Consolidated Financial Statements (Continued)

Note 1: Summary of Significant Accounting Policies (Continued)

Long-Lived Assets Including Finite-Lived Purchased Intangible Assets

HP amortizes purchased intangible assets with finite lives using the straight-line method over the estimated economic

lives of the assets, ranging from one to ten years.

HP evaluates long-lived assets, such as property, plant and equipment and purchased intangible assets with finite lives,

for impairment whenever events or changes in circumstances indicate the carrying value of an asset may not be recoverable

in accordance with SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets.” HP assesses the fair

value of the assets based on the undiscounted future cash flow the assets are expected to generate and recognizes an

impairment loss when estimated undiscounted future cash flow expected to result from the use of the asset plus net proceeds

expected from disposition of the asset, if any, are less than the carrying value of the asset. When HP identifies an impairment,

HP reduces the carrying amount of the asset to its estimated fair value based on a discounted cash flow approach or, when

available and appropriate, to comparable market values.

Derivative Financial Instruments

HP uses derivative financial instruments, primarily forwards, swaps, and options, to hedge certain foreign currency and

interest rate exposures. HP also may use other derivative instruments not designated as hedges such as forwards used to

hedge foreign currency balance sheet exposures. HP does not use derivative financial instruments for speculative purposes.

See Note 9 for a full description of HP’ s derivative financial instrument activities and related accounting policies, which is

incorporated herein by reference.

Investments

HP’ s investments consist principally of time deposits, commercial paper, corporate debt, other debt securities, and equity

securities of publicly-traded and privately-held companies. HP classifies investments with maturities of less than one year as

short-term investments.

HP classifies its investments in debt securities and its equity investments in public companies as available-for-sale

securities and carries them at fair value. HP determines fair values for investments in public companies using quoted market

prices. HP records the unrealized gains and losses on available-for-sale securities, net of taxes, in accumulated other

comprehensive income (loss).

HP carries equity investments in privately-held companies at the lower of cost or fair value. HP may estimate fair values

for investments in privately-held companies based upon one or more of the following: pricing models using historical and

forecasted financial information and current market rates; liquidation values; the values of recent rounds of financing; and

quoted market prices of comparable public companies.

Losses on Investments

HP monitors its investment portfolio for impairment on a periodic basis. In the event that the carrying value of an

investment exceeds its fair value and the decline in value is determined to be other than temporary, HP records an impairment

charge and establishes a new cost basis for the investment at its current fair value. In order to determine whether a decline in

value is other than temporary, HP evaluates, among other factors: the duration and extent to which the fair value has been

less than the

83