HP 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

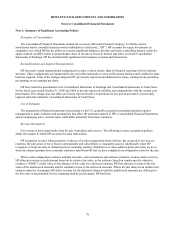

Notes to Consolidated Financial Statements (Continued)

Note 1: Summary of Significant Accounting Policies (Continued)

carrying value; the financial condition of and business outlook for the company or financial institution, including key

operational and cash flow metrics, current market conditions and future trends in the issuer’ s industry; the company’ s relative

competitive position within the industry; and HP’ s intent and ability to retain the investment for a period of time sufficient to

allow for any anticipated recovery in fair value.

HP determined the declines in value of certain investments to be other than temporary. Accordingly, HP recorded

impairments of approximately $28 million in fiscal 2007, $8 million in fiscal 2006 and $43 million in fiscal 2005. HP

includes these impairments in gains (losses) on investments in the Consolidated Statements of Earnings. Depending on

market conditions, HP may record additional impairments on its investment portfolio in the future.

Concentrations of Credit Risk

Financial instruments that potentially subject HP to significant concentrations of credit risk consist principally of cash

and cash equivalents, investments, accounts receivable from trade customers and from contract manufacturers, financing

receivables and derivatives.

HP maintains cash and cash equivalents, short and long-term investments, derivatives and certain other financial

instruments with various financial institutions. These financial institutions are located in many different geographical regions

and HP’ s policy is designed to limit exposure with any one institution. As part of its cash and risk management processes, HP

performs periodic evaluations of the relative credit standing of the financial institutions. HP has not sustained material credit

losses from instruments held at financial institutions. HP utilizes forward contracts and other derivative contracts to protect

against the effects of foreign currency fluctuations. Such contracts involve the risk of non-performance by the counterparty,

which could result in a material loss.

HP sells a significant portion of its products through third-party distributors and resellers and, as a result, maintains

individually significant receivable balances with these parties. If the financial condition or operations of these distributors

and resellers deteriorate substantially, HP’ s operating results could be adversely affected. The ten largest distributor and

reseller receivable balances collectively, which were concentrated primarily in North America, represented approximately

23% of gross accounts receivable at October 31, 2007 and 21% at October 31, 2006. No single customer accounts for more

than 10% of accounts receivable. Credit risk with respect to other accounts receivable and financing receivables is generally

diversified due to the large number of entities comprising HP’ s customer base and their dispersion across many different

industries and geographical regions. HP performs ongoing credit evaluations of the financial condition of its third-party

distributors, resellers and other customers and requires collateral, such as letters of credit and bank guarantees, in certain

circumstances. To ensure a receivable balance is not overstated due to uncollectibility, an allowance for doubtful accounts is

maintained as required under U.S. generally accepted accounting principles. The past due or delinquency status of a

receivable is based on the contractual payment terms of the receivable. The need to write off a receivable balance depends on

the age, size and a determination of collectibility of the receivable. HP generally has experienced longer accounts receivable

collection cycles in its emerging markets, in particular Asia Pacific and Latin America, compared to its United States and

European markets. In the event that accounts receivable collection cycles in emerging markets significantly deteriorate or one

or more of HP’ s larger resellers in these regions fail, HP’ s operating results could be adversely affected.

84