HP 2007 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

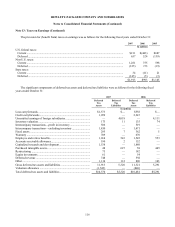

Note 13: Taxes on Earnings (Continued)

The IRS has completed its examination of the income tax returns of HP for all years through fiscal 1998. HP’ s 1993

through 1998 years were settled with the IRS’ s Appeals Division and the settlements were approved by the Joint Committee

on Taxation in 2006. These tax years remain open for net operating loss and foreign tax credit carrybacks from subsequent

years if the IRS’ s audits of those years approve such carrybacks.

On June 28, 2007, HP received a Notice of Deficiency from the IRS for its fiscal 1999 and 2000 tax years. The Notice of

Deficiency asserted that HP owes additional tax of $13 million for these two years. At the same time, HP received a Revenue

Agent’ s Report (“RAR”) from IRS for its fiscal 2001 tax year that proposed no change in HP’ s tax liability for that year. In

addition to the proposed deficiencies for fiscal 1999 and 2000, the IRS’ s adjustments, if sustained, would reduce tax refund

claims HP has filed for foreign tax credit and net operating loss carrybacks to earlier fiscal years and reduce the tax benefits

of carryforwards to subsequent years, by approximately $361 million. HP plans to contest certain of the adjustments

proposed in the Notice of Deficiency and the RAR. Towards this end, HP filed a Petition with the United States Tax Court on

September 25, 2007. HP believes that it has provided adequate reserves for any tax deficiencies or reductions in refund

claims that could result from the IRS actions.

As of October 31, 2007, the IRS was in the process of concluding its examination of HP’ s income tax returns for years

2002 and 2003. The IRS began an audit of HP’ s 2004 and 2005 income tax returns in 2007. In addition, HP is subject to

numerous ongoing audits by state and foreign tax authorities. HP believes that adequate accruals have been provided for all

HP open tax years.

All Compaq tax years through the merger date with HP, May 3, 2002, have been audited and agreed with the IRS.

During fiscal 2007 substantially all of the remaining tax accruals for Compaq were reclassified as a reduction of goodwill

upon closing of the statute of limitations.

HP has not provided for U.S. federal income and foreign withholding taxes on $7.7 billion of undistributed earnings

from non-U.S. operations as of October 31, 2007 because HP intends to reinvest such earnings indefinitely outside of the

United States. If HP were to distribute these earnings, foreign tax credits may become available under current law to reduce

the resulting U.S. income tax liability. Determination of the amount of unrecognized deferred tax liability related to these

earnings is not practicable. HP will remit non-indefinitely reinvested earnings of its non-US subsidiaries where excess cash

has accumulated and it determines that it is advantageous for business operations, tax or cash reasons.

American Jobs Creation Act of 2004—Repatriation of Foreign Earnings

The American Jobs Creation Act of 2004 (“the Jobs Act”), enacted on October 22, 2004, provided for a temporary 85%

dividends received deduction on certain foreign earnings repatriated during a one-year period. The deduction resulted in an

approximate 5.25% federal tax rate on the repatriated earnings. During the third quarter of fiscal 2005, HP’ s CEO and Board

of Directors approved a domestic reinvestment plan as required by the Jobs Act to repatriate $14.5 billion in foreign earnings

in fiscal 2005.

HP recorded tax expense in fiscal 2005 of $792 million related to this $14.5 billion dividend under the Jobs Act. The

additional tax expense consists of federal taxes of $744 million, state taxes, net of

119