HP 2007 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

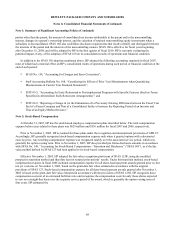

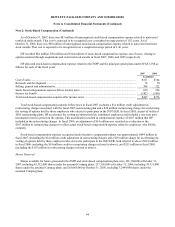

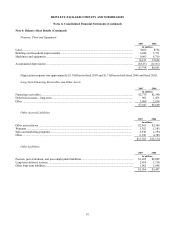

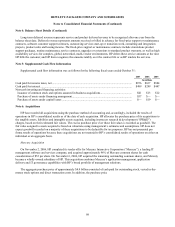

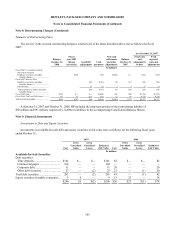

Note 4: Balance Sheet Details (Continued)

Long-term deferred revenue represents service and product deferred revenue to be recognized after one year from the

balance sheet date. Deferred revenue represents amounts received or billed in advance for fixed-price support or maintenance

contracts, software customer support contracts, outsourcing services start-up or transition work, consulting and integration

projects, product sales and leasing income. The fixed-price support or maintenance contracts include stand-alone product

support packages, routine maintenance service contracts, upgrades or extensions to standard product warranty, as well as high

availability services for complex, global, networked, multi-vendor environments. HP defers these service amounts at the time

HP bills the customer, and HP then recognizes the amounts ratably over the contract life or as HP renders the services.

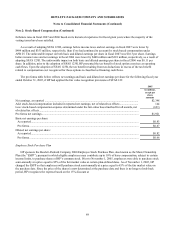

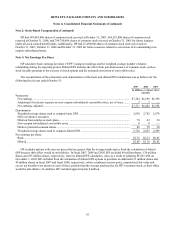

Note 5: Supplemental Cash Flow Information

Supplemental cash flow information was as follows for the following fiscal years ended October 31:

2007 2006 2005

In millions

Cash paid for income taxes, net ............................................................................................................... $956 $637 $884

Cash paid for interest ............................................................................................................................... $489 $299 $447

Non-cash investing and financing activities:

Issuance of common stock and options assumed in business acquisitions............................................ $41 $13 $12

Purchase of assets under financing arrangement................................................................................... $57 $— $—

Purchase of assets under capital leases ................................................................................................. $— $19 $—

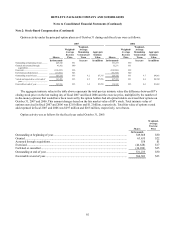

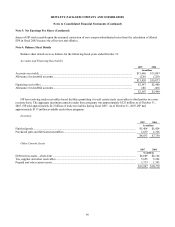

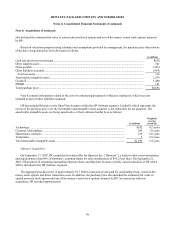

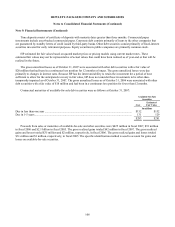

Note 6: Acquisitions

HP has recorded all acquisitions using the purchase method of accounting and, accordingly, included the results of

operations in HP’ s consolidated results as of the date of each acquisition. HP allocates the purchase price of its acquisitions to

the tangible assets, liabilities and intangible assets acquired, including in-process research & development (“IPR&D”)

charges, based on their estimated fair values. The excess purchase price over those fair values is recorded as goodwill. The

fair value assigned to assets acquired is based on valuations using management’ s estimates and assumptions. HP does not

expect goodwill recorded on a majority of these acquisitions to be deductible for tax purposes. HP has not presented pro

forma results of operations because these acquisitions are not material to HP’ s consolidated results of operations on either an

individual or an aggregate basis.

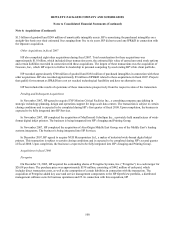

Mercury Acquisition

On November 2, 2006, HP completed its tender offer for Mercury Interactive Corporation (“Mercury”), a leading IT

management software and services company, and acquired approximately 96% of Mercury common shares for cash

consideration of $52 per share. On November 6, 2006, HP acquired the remaining outstanding common shares, and Mercury

became a wholly owned subsidiary of HP. This acquisition combines Mercury’ s application management, application

delivery and IT governance capabilities with HP’ s broad portfolio of management solutions.

The aggregate purchase price of approximately $4.9 billion consisted of cash paid for outstanding stock, vested in-the-

money stock options and direct transaction costs. In addition, the purchase price

98