HP 2007 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

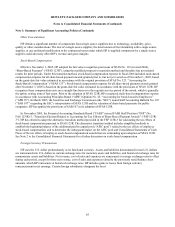

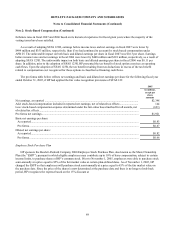

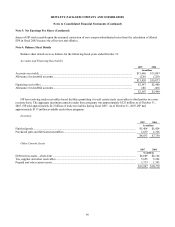

Note 2: Stock-Based Compensation (Continued)

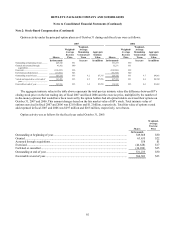

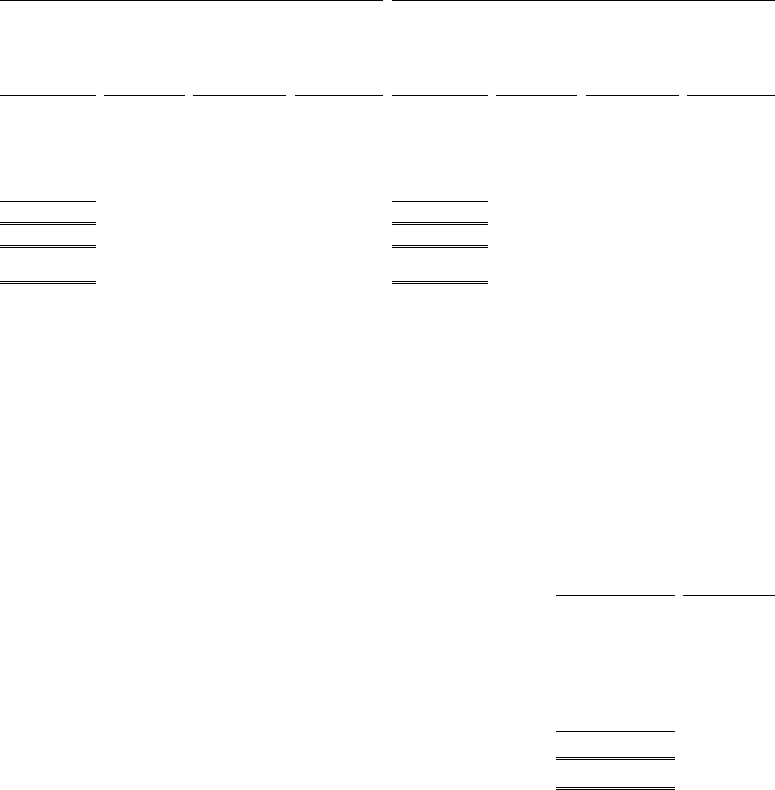

Option activity under the principal option plans as of October 31 during each fiscal year were as follows:

2007 2006

Shares

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value Shares

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

In thousands In years In millions In thousands In years In millions

Outstanding at beginning of year........... 445,740 $31 531,233 $30

Granted and assumed through

acquisitions ......................................

45,562 $40 52,271 $31

Exercised................................................ (106,302) $26 (100,986) $22

Forfeited/cancelled/expired ................... (17,661) $43 (36,778) $40

Outstanding at end of year..................... 367,339 $33 4.2 $7,375 445,740 $31 4.7 $4,861

Vested and expected to vest at end of

year...................................................

361,496 $33 4.2 $7,256 437,109 $31 4.6 $4,742

Exercisable at end of year...................... 265,366 $33 3.4 $5,298 316,341 $33 4.0 $3,081

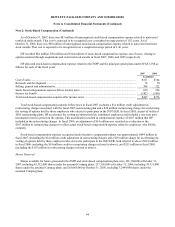

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the difference between HP’ s

closing stock price on the last trading day of fiscal 2007 and fiscal 2006 and the exercise price, multiplied by the number of

in-the-money options) that would have been received by the option holders had all option holders exercised their options on

October 31, 2007 and 2006. This amount changes based on the fair market value of HP’ s stock. Total intrinsic value of

options exercised in fiscal 2007 and 2006 was $2.0 billion and $1.2 billion, respectively. Total fair value of options vested

and expensed in fiscal 2007 and 2006 was $297 million and $265 million, respectively, net of taxes.

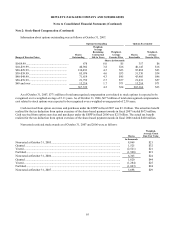

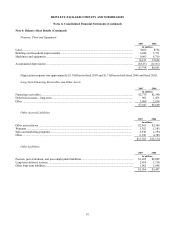

Option activity was as follows for the fiscal year ended October 31, 2005:

Shares

Weighted-

Average

Exercise

Price

In thousands

Outstanding at beginning of year...................................................................................................... 549,868 $30

Granted ............................................................................................................................................. 63,635 $22

Assumed through acquisitions .......................................................................................................... 558 $1

Exercised .......................................................................................................................................... (46,628) $17

Forfeited or cancelled ....................................................................................................................... (36,200) $35

Outstanding at end of year................................................................................................................ 531,233 $30

Exercisable at end of year................................................................................................................. 386,303 $33

92