HP 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

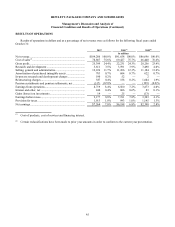

dollar against the euro and the yen. As a percentage of net revenue, each of our segments experienced a year-over-year

decrease or no change in fiscal 2006.

Amortization of Purchased Intangible Assets

The increase in amortization expense in fiscal 2007 as compared to fiscal 2006 was due primarily to amortization

expense related to the acquisition of Mercury in the first quarter of fiscal 2007. This increase was partially offset by a

decrease in amortization expense related to certain intangible assets associated with prior acquisitions, including the Compaq

Computer Corporation (“Compaq”) acquisition, that had reached the end of their amortization period.

The decrease in amortization expense in fiscal 2006 as compared to fiscal 2005 was due primarily to a decrease in

amortization expense related to certain intangible assets associated with prior acquisitions including the Compaq acquisition

that had reached the end of their amortization period, which decrease was partially offset by an increase in amortization

expense related primarily to the acquisitions of Scitex Vision Ltd. (“Scitex”), Peregrine Systems, Inc. (“Peregrine”), and

OuterBay Technologies, Inc. (“OuterBay”) in fiscal year 2006.

For more information on our amortization of purchased intangibles assets, see Note 7 to the Consolidated Financial

Statements in Item 8, which is incorporated herein by reference.

In-Process Research and Development Charges

We record in-process research and development (“IPR&D”) charges in connection with acquisitions accounted for as

business combinations, as more fully described in Note 6 to the Consolidated Financial Statements in Item 8. In fiscal 2007,

2006 and 2005 we recorded IPR&D charges of $190 million, $52 million, and $2 million, respectively, related to acquisitions

during those years. The increase in IPR&D in fiscal 2007 was due primarily to our acquisition of Mercury in the first quarter

of fiscal 2007.

Restructuring Charges

Restructuring charges for fiscal 2007 were $387 million, which included $354 million of expenses related to severance

and other benefit costs associated with those employees who elected to participate in the 2007 EER and a net charge of

$33 million relating to adjustments to our fiscal 2005, 2003, 2002 and 2001 restructuring programs.

Restructuring charges in fiscal year 2006 were $158 million. This included a net charge of $233 million related to true-

ups of severance and other related restructuring charges for all restructuring plans, a $6 million termination benefits expense

and a $3 million settlement and curtailment loss from our non-U.S. pension plans related to the fiscal 2005 restructuring plan,

which was approved by our Board of Directors in the fourth quarter of fiscal 2005. These charges were partially offset by a

$46 million settlement gain from the U.S. pension plans, a $24 million curtailment gain from the U.S. retiree medical

program and a $14 million adjustment to reduce our non-cash stock-based compensation expense, all related to our fiscal

2005 restructuring plan approved in the fourth quarter of fiscal 2005.

Restructuring charges in fiscal 2005 were $1.7 billion, which included a $1.6 billion charge for the fiscal 2005

restructuring plan approved in the fourth quarter of fiscal 2005. The fiscal 2005 restructuring plan was designed to simplify

our structure, reduce costs and place greater focus on our customers. We initially estimated that 15,300 positions would be

eliminated in the fiscal 2005 restructuring plan.

49