HP 2007 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

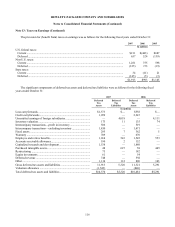

Note 13: Taxes on Earnings (Continued)

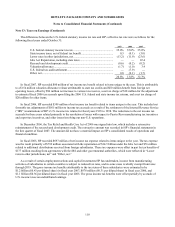

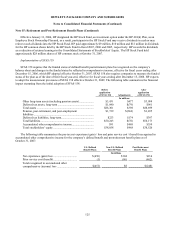

The differences between the U.S. federal statutory income tax rate and HP’ s effective tax rate were as follows for the

following fiscal years ended October 31:

2007 2006 2005

U.S. federal statutory income tax rate ....................................................... 35.0% 35.0% 35.0%

State income taxes, net of federal tax benefit ............................................ 0.5 (0.1) (3.0)

Lower rates in other jurisdictions, net ....................................................... (13.2) (11.9) (23.6)

Jobs Act Repatriation, including state taxes .............................................. — — 22.4

Research and development credit .............................................................. (0.6) (0.2) (0.2)

Valuation allowance .................................................................................. (1.7) (1.0) 3.4

U.S. federal tax audit settlement................................................................ — (7.9) —

Other, net................................................................................................... 0.8 (0.1) (1.7)

20.8% 13.8% 32.3%

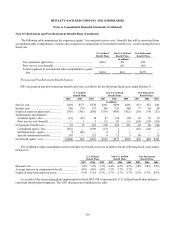

In fiscal 2007, HP recorded $80 million of net income tax benefit related to items unique to the year. This is attributable

to a $154 million valuation allowance release attributable to state tax credits and $60 million benefit from foreign net

operating losses, offset by $96 million net increase to various tax reserves, a net tax charge of $18 million for the adjustment

to estimated fiscal 2006 tax accruals upon filing the 2006 U.S. federal and state income tax returns, and a net tax charge of

$20 million for other items.

In fiscal 2006, HP recorded $599 million of net income tax benefit related to items unique to the year. This included net

favorable tax adjustments of $565 million to income tax accruals as a result of the settlement of the Internal Revenue Service

(“IRS”) examinations of HP’ s U.S. income tax returns for fiscal years 1993 to 1998. The reductions to the net income tax

accruals for these years related primarily to the resolution of issues with respect to Puerto Rico manufacturing tax incentives

and export tax incentives, and other issues involving our non-U.S. operations.

In December 2006, the Tax Relief and Health Care Act of 2006 was signed into law, which includes a retroactive

reinstatement of the research and development credit. The retroactive amount was recorded in HP’ s financial statements in

the first quarter of fiscal 2007. The amount did not have a material impact on HP’ s consolidated results of operations and

financial condition.

In fiscal 2005, HP recorded $697 million of net income tax expense related to items unique to the year. The tax expense

was the result primarily of $792 million associated with the repatriation of $14.5 billion under the Jobs Act and $76 million

related to additional distributions received from foreign subsidiaries. These tax expenses were offset in part by tax benefits of

$177 million resulting from agreements with the IRS and other governmental authorities, which were reflected in “Lower

rates in other jurisdictions, net” and “Other, net.”

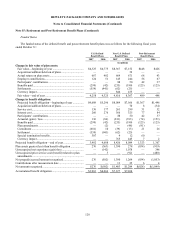

As a result of certain employment actions and capital investments HP has undertaken, income from manufacturing

activities of subsidiaries in certain countries is subject to reduced tax rates, and in some cases is wholly exempt from taxes

through 2019. The gross income tax benefits attributable to the tax status of these subsidiaries were estimated to be

$1.2 billion ($0.43 per diluted share) in fiscal year 2007, $876 million ($0.31 per diluted share) in fiscal year 2006, and

$1.1 billion ($0.36 per diluted share) in fiscal year 2005. The gross income tax benefits were offset partially by accruals of

U.S. income taxes on undistributed earnings.

118