HP 2007 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

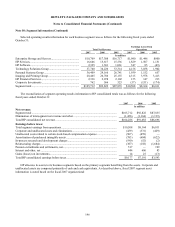

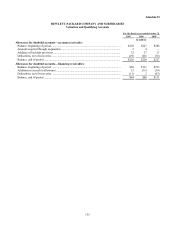

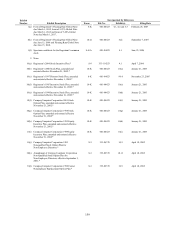

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Quarterly Summary

(Unaudited)

Three-month periods ended

January 31 April 30 July 31 October 31

In millions, except per share amounts

2007

Net revenue........................................................................................................................................... $25,082 $25,534 $25,377 $28,293

Cost of sales(1) ....................................................................................................................................... 19,136 19,283 19,164 21,304

Research and development ................................................................................................................... 877 903 917 914

Selling, general and administrative ...................................................................................................... 2,908 3,044 3,002 3,272

Amortization of purchased intangible assets........................................................................................ 201 212 183 187

In-process research and development charges .....................................................................................167 19 — 4

Restructuring......................................................................................................................................... (41) 453 (5) (20)

Pension curtailments and pension settlements, net...............................................................................(9) (508) — —

Total costs and expenses....................................................................................................................... 23,239 23,406 23,261 25,661

Earnings from operations...................................................................................................................... 1,843 2,128 2,116 2,632

Interest and other, net ........................................................................................................................... 111 87 165 81

Gains (losses) on investments............................................................................................................... 10 13 5(14)

Earnings before taxes............................................................................................................................ 1,964 2,228 2,286 2,699

Provision for taxes ................................................................................................................................ 417 453 508 535

Net earnings .......................................................................................................................................... $1,547 $1,775 $1,778 $2,164

Net earnings per share:(2)

Basic ................................................................................................................................................. $0.57 $0.67 $0.68 $0.84

Diluted .............................................................................................................................................. $0.55 $0.65 $0.66 $0.81

Cash dividends paid per share .............................................................................................................. $0.08 $0.08 $0.08 $0.08

Range of per share closing stock prices on the New York Stock Exchange

Low................................................................................................................................................... $38.22 $38.67 $42.83 $46.01

High .................................................................................................................................................. $43.53 $43.13 $48.54 $52.87

2006

Net revenue........................................................................................................................................... $22,659 $22,554 $21,890 $24,555

Cost of sales(1) ....................................................................................................................................... 17,392 16,970 16,472 18,593

Research and development ................................................................................................................... 871 930 920 870

Selling, general and administrative ...................................................................................................... 2,692 2,858 2,830 2,886

Amortization of purchased intangible assets........................................................................................ 147 151 153 153

In-process research and development charges .....................................................................................50 2 — —

Restructuring......................................................................................................................................... 15 (14) 5152

Total costs and expenses....................................................................................................................... 21,167 20,897 20,380 22,654

Earnings from operations...................................................................................................................... 1,492 1,657 1,510 1,901

Interest and other, net ........................................................................................................................... 38 157 221 190

(Losses) gains on investments .............................................................................................................. (2) 6 714

Earnings before taxes............................................................................................................................ 1,528 1,820 1,738 2,105

Provision for (benefit from) taxes ........................................................................................................ 301 (79) 363 408

Net earnings .......................................................................................................................................... $1,227 $1,899 $1,375 $1,697

Net earnings per share:(2)

Basic ................................................................................................................................................. $0.43 $0.68 $0.50 $0.62

Diluted .............................................................................................................................................. $0.42 $0.66 $0.48 $0.60

Cash dividends paid per share .............................................................................................................. $0.08 $0.08 $0.08 $0.08

Range of per share closing stock prices on the New York Stock Exchange and Nasdaq Stock

Market:

Low................................................................................................................................................... $28.12 $30.27 $29.79 $31.67

High .................................................................................................................................................. $32.24 $34.36 $33.87 $39.87

(1) Cost of products, cost of services and financing interest.

(2) EPS for each quarter is computed using the weighted-average number of shares outstanding during that quarter, while

EPS for the fiscal year is computed using the weighted-average number of shares outstanding during the year. Thus, the

sum of the EPS for each of the four quarters may not equal the EPS for the fiscal year.

150