HP 2007 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 14: Stockholders’ Equity (Continued)

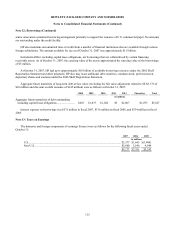

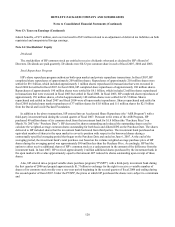

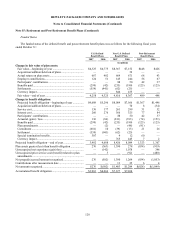

The components of accumulated other comprehensive income, net of taxes, were as follows for the following fiscal years

ended October 31:

2007 2006

In millions

Net unrealized gains on available-for-sale securities...................................................................... $4 $16

Net unrealized losses on cash flow hedges..................................................................................... (64) (46)

Cumulative translation adjustment ................................................................................................. 173 67

Additional minimum pension liability............................................................................................ — (19)

Unrealized components of defined benefit pension plan ................................................................ 446 —

Accumulated other comprehensive income .................................................................................... $559 $18

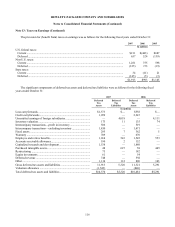

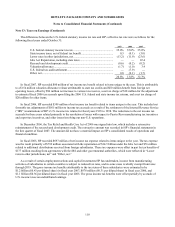

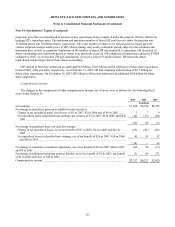

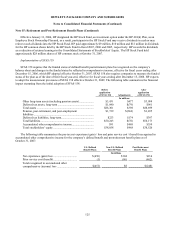

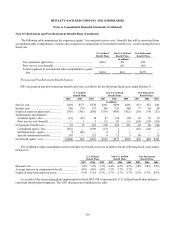

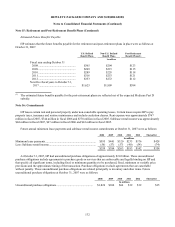

Note 15: Retirement and Post-Retirement Benefit Plans

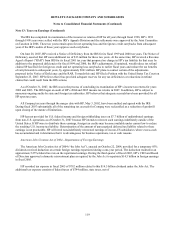

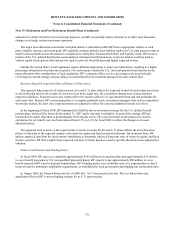

Plan Design Changes

In fiscal 2007, HP modified its U.S. defined benefit pension plan for the remaining number of U.S. employees still

accruing benefits under the program. Effective January 1, 2008, these employees will cease accruing pension benefits, and

HP will calculate the final pension benefit amount based on pay and service through December 31, 2007. In addition, HP

limited future eligibility for the Pre-2003 HP Retiree Medical Program to those employees who were within five years of

satisfying the program’ s retirement criteria on June 30, 2007. These actions resulted in reductions to the U.S. defined benefit

and post-retirement plan obligations. As a result, HP recognized one-time curtailment gains of $541 million for the U.S.

defined benefit pension plan and $1 million for the post-retirement benefit plan. As part of this announcement, HP offered an

option for eligible affected employees to participate in the 2007 EER. A total of 3,080 employees participated in the 2007

EER. HP recognized a special termination benefit expense of $307 million in fiscal 2007, which reflects aggregate additional

lump-sum benefits that HP expects to pay to those individuals participating in the 2007 EER. HP will distribute this amount

from the plan assets. Also, HP recognized a special termination benefit expense of $60 million for the HP retiree medical

plans for those employees participating in the 2007 EER. This expense amount reflects the additional medical coverage that

HP expects to provide to those employees participating in the 2007 EER. The total $367 million expense for the 2007 EER

was included in the restructuring charge of fiscal 2007. HP will fund the cash expenditures associated with the 2007 EER

primarily by using available U.S. pension plan assets. Eligible employees whose pension accruals will cease effective

December 31, 2007 will benefit from an increased company 401(k) match opportunity from 4 percent to 6 percent of eligible

earnings effective January 1, 2008.

In fiscal 2007, HP also recognized a net settlement loss of $8 million for its U.S. pension plans, including a settlement

loss of $36 million, which was partially offset by a settlement gain of $28 million for its U.S. pension plans. The settlement

loss of $36 million related to the distributions and the subsequent transfer of accrued pension benefits from the U.S. Excess

Benefit Plan to the U.S. Executive Deferred Compensation Plan for the terminated vested plan participants. The distributions

and the transfer of this pension obligation represented a reduction in the projected benefit obligation and exceeded the sum of

service and interest cost for this plan. As a result, HP recognized a portion of the unrecognized loss, re-measured as of

January 31, 2007, in the second quarter of fiscal 2007. The settlement gain of $28 million primarily resulted from the

distribution of lump-sum benefit payments

122